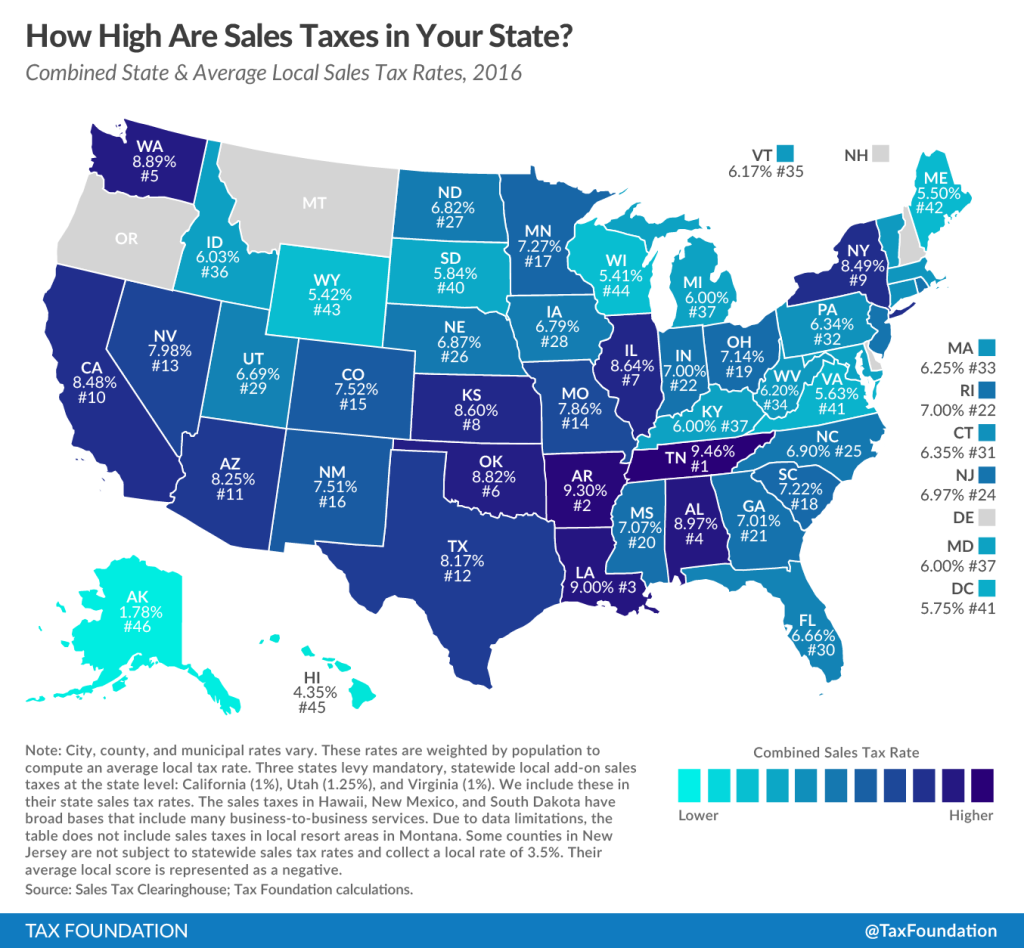

The Tax Foundation, a non-partisan public policy think tank, has released its analysis of sales tax levels across the country, and it is not good news for Alabamians. According to the study, the state of Alabama has the fourth highest combined sales tax rate in the country.

The five states with the highest average combined state and local sales tax rates are Tennessee (9.46 percent), Arkansas (9.30 percent), Louisiana (9.0 percent), Alabama (8.97 percent), and Washington (8.90 percent).

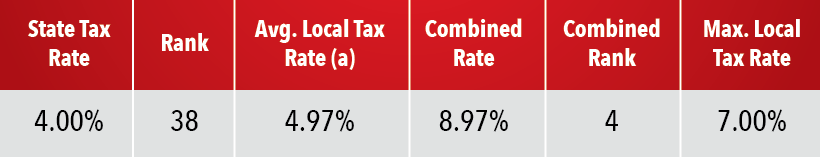

As far as the tax set by the state government goes, the Yellowhammer State only has a 4 percent statewide rate; good enough for twelfth lowest in the country. However, the state tax code allows for localities to tack on an additional 7 percent, leading to an average 4.97 percent additional charge. That number, plus the state’s 4 percent, is how the Tax Foundation calculated the average combined rate of 8.97 percent.

The study drew data from the Sales Tax Clearinghouse, which publishes quarterly sales tax data at the state, county, and city levels by ZIP code. the Tax Foundation weighted these numbers according to Census 2010 population figures in an attempt to give a sense of the prevalence of sales tax rates in a particular state.

Additionally, Alabama is one of only 14 states that levies a sales tax on groceries. It is only one of seven that taxes such items at the normal sales tax rate.

Alabama’s budgetary structure relies heavily on the sales taxes and therefore is largely dependent on consumer spending. The sales tax, along with other so-called “growth taxes”, all go to the Education Trust Fund Budget while the state’s General Fund is fueled by a hodge-podge of over 40 miscellaneous revenue streams. Such a set up has been shown to cause instability, with the two budget system resulting in a paradox of a surplus and a shortage at the same time in 2015.

Many who support a reliance on sales taxes tout it as superior to an alternative increase on income taxes. In addtion, advocates for such a system believe that a sales tax heavy formula will keep taxes low, as the people would feel the bite much more if everything they bought came with a double-digit sales tax. Tax increases would be more visible — and more unpopular for politicians to propose.

However, those that oppose a reliance on sales tax note that it is much tougher to keep track of how much money one contributes to the government. Unlike an income tax, sales taxes do not come with a year-end receipt. Citizens can never truly know how much they paid in without keeping track of an endless sea of receipts.

The study from the Tax Foundation can be seen in its entirety on their website linked here.