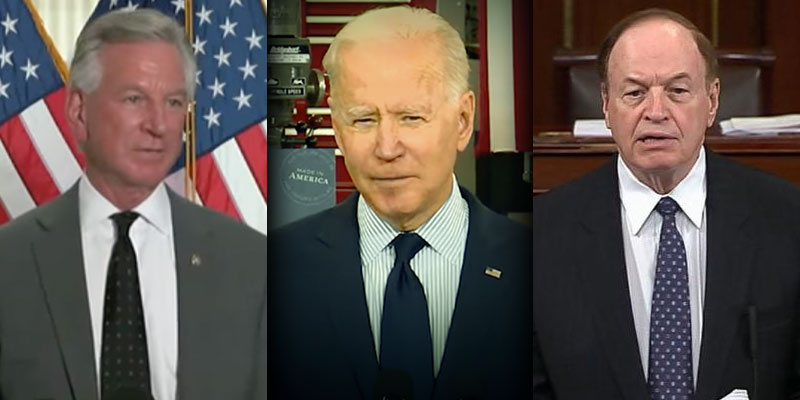

U.S. Sens. Richard Shelby (R-AL) and Tommy Tuberville (R-AL) affirmed on Wednesday their opposition to President Joe Biden’s proposed tax increase on family-owned businesses.

Biden has proposed a series of tax increases to fund his infrastructure proposal. Among them is a capital gains tax increase which would have a disproportionate impact on multi-generation farming and ranch operations.

Shelby and Tuberville joined the entire Senate Republican caucus in sending a letter to Biden urging him to abandon the proposed hike.

The letter noted that current tax laws are designed to prevent family-owned businesses, farms and ranches “from being hit with a crippling tax bill when a family member passes away.”

The Senate Republicans described it as “a new backdoor death tax on Americans.”

Under Biden’s proposal, many businesses would be forced to pay tax on the appreciated gains from prior generations of family owners despite receiving no actual gain.

The result would be hard choices facing the next generation of owners, a factor highlighted by Shelby, Tuberville and the other senators.

“These businesses consist largely of illiquid assets that will in many cases need to be sold or leveraged in order to pay the new tax burden. Making these changes could force business operators to sell property, lay off employees, or close their doors just to cover these new tax obligations,” they wrote.

Certain areas of the country would be especially vulnerable to the economic instability brought on by such a tax increase, according to the letter’s signers.

“These changes are a significant tax increase that would hit family-owned businesses, farms, and ranches hard, particularly in rural communities,” the senators wrote.

Danielle Beck, a representative of the National Cattlemen’s Beef Association, expressed her members’ concern for the economic impact of Biden’s plan in a joint statement from the group.

“Family-owned agricultural operations are the economic drivers of rural communities across the United States; therefore, it is imperative that this Administration understand that resiliency can only be achieved and maintained when new generations – whether their family has had a long history in agriculture, or they are breaking into the industry – can build upon the contributions of today’s farmers and ranchers,” she said.

Transfer of ownership is an essential part of a business plan for many agricultural operations, according to Zippy Duvall, president of the American Farm Bureau Federation.

“Passing on the family farm to the next generation is a top priority for many farmers and ranchers,” he stated. “Eliminating stepped-up basis and increasing capital gains taxes will make it much more difficult, or even impossible, for parents to pass on their farm or ranch to their children. This is a critical tool for America’s farmers and ranchers, and we urge all members of Congress to oppose efforts to eliminate it.”

The Republican senators cited a recent study by E&Y which found that the proposed changes in the tax law could cost the U.S. economy up to 100,000 jobs per year.

The group also referred to a study by the Texas A&M Agricultural and Food Policy Center that determined that 98% of the farms in its 30-state database would be impacted by the Biden proposal, with an average tax increase of $726,104 per farm.

Tim Howe is an owner of Yellowhammer Multimedia