The Alabama legislature got off to a slow start on Tuesday, with Democrats in the Senate beginning their filibustering literally five minutes into the session.

But by Thursday, Republicans — especially in the House — had achieved their goal of passing multiple bills offering relief to Alabama taxpayers.

Here’s a quick rundown of the tax relief bills the House and Senate passed in the first week of the 2014 session:

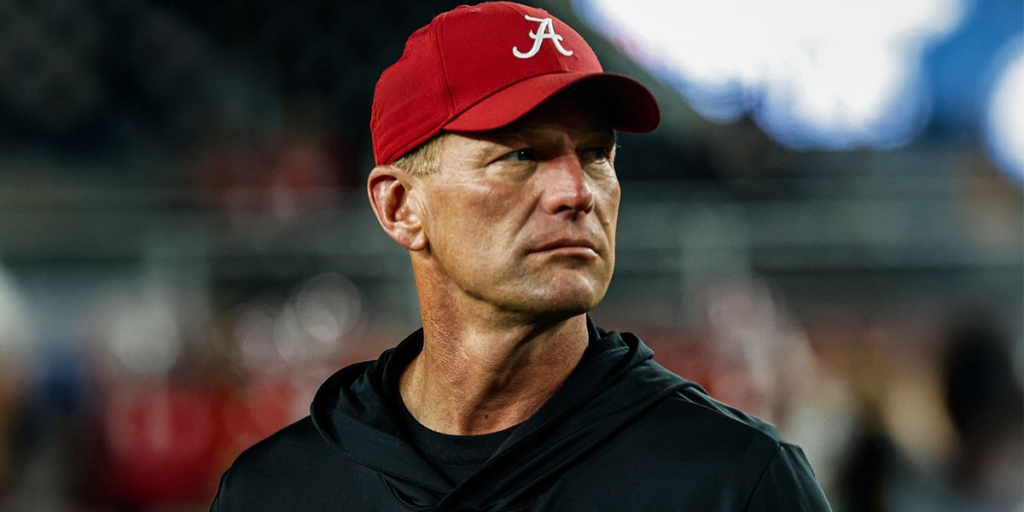

Small Business Tax Relief Act sponsored by Rep. Barry Moore, R-Enterprise & Sen. Bryan Taylor, R-Prattville

Alabama small business owners are currently required to make up-front sales tax payments to the state based on an educated guess. The threshold for making those estimated payments is $1,000 right now. This bill raises that limit to $2,500. Republicans say the bill will give 6,000 small business owners an immediate tax cut up to $2,500 and will inject roughly $4.6 million into the economy. Moore and Taylor passed identical bills in their respective chambers.

The passage of the Small Business Tax Relief Act capped off a big week for Rep. Moore, who also introduced a bill to render ObamaCare “null and void” in Alabama.

Tax Elimination Act sponsored by Rep. Jim Patterson, R-Meridianville

Apparently the Alabama Dept. of Revenue has been collecting some taxes and fees that cost more to collect than they actually bring in. Rep. Patterson’s would stop that from happening moving forward. On the chopping block as a result of this bill are taxes on iron ore and playing cards. Those two taxes generated a combined annual average of less than $100,000 in revenue for the State General Fund but were costing roughly $115,000 to collect.

Taxpayers’ Bill of Rights sponsored by Rep. Paul DeMarco, R-Homewood

Under current law, the Department of Revenue is judge, jury, and executioner when it comes to the tax assessment appeals process. They have a vested interested in denying an appeal. The Taxpayers’ Bill of Rights lays out an streamlined, independent process for hearing tax appeals.

“This bill will ensure that businesses and individual taxpayers choosing to appeal tax assessments are given a level playing field and referees who will remain neutral from the beginning of the process to the end,” DeMarco said.

The bill also abolishes the Administrative Law Division of the Department of Revenue and transfers its budget, personnel, equipment and functions to the newly-formed Tax Appeals Commission. Doing so will bring Alabama into conformity with the vast majority of states that have created an independent tax appeals process for both businesses and individuals.

Business Tax Streamlining Act sponsored by Rep. Greg Wren, R- Montgomery

This bill streamlines the process for filing business personal property taxes by creating a new online filing system that will be a “one-stop-shop” for filing these taxes. It also allow businesses claiming $10,000 or less in business personal property tax to file a short form that does not require them to itemize their property.

Follow Cliff on Twitter @Cliff_Sims