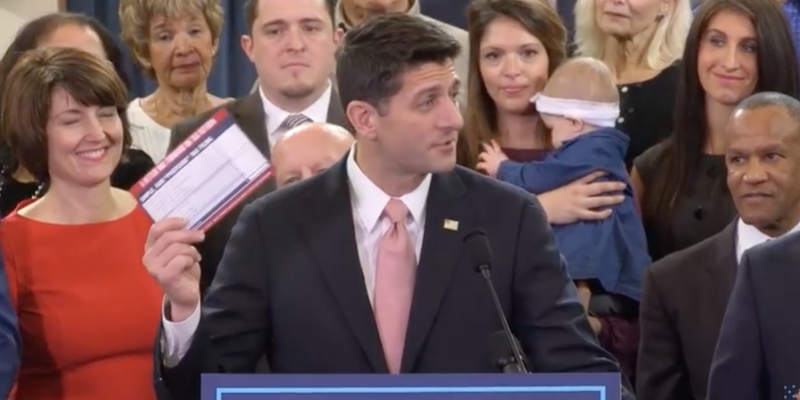

After plenty of talk from President Trump and Republican members of Congress about plans to drastically cut taxes and simplify the tax code, the GOP finally revealed their tax reform bill late last week.

Many critics of the bill have expressed concern about the spending cuts required to pay for the proposed changes while avoiding an increase to the federal budget deficit.

One such spending cut comes in the form of a lowered cap on the mortgage interest deduction on newly purchased homes, a change that has many homeowners across the country wondering about how the housing market would be affected. Under the proposed law, the deductible home mortgage would be cut by 50 percent, from a mortgage debt cap of $1,000,000 to $500,000.

In Alabama, where the median home value is $126,000, of particular concern is how the changes to mortgage interest deductions would affect the middle-class.

“It’s time for a tax code that puts working Americans first,” U.S. Rep. Robert Aderholt (R-Haleyville) said Thursday. “More than 80 percent of the people in my district will see their tax burden drop, and to me, that is a good thing.”

But other estimates paint a somewhat more worrisome picture for middle-class Alabama homeowners, and it is clear that not everyone will benefit.

According to an analysis by the National Association of Realtors (NAR), the House Republican blueprint for tax reform, which provided the basis for the proposed bill, would cause home values across the country to drop by 10 percent while raising taxes on middle-class homeowners by an average of $815.

“Realtors believe in the promise of lower tax rates,” NAR President William E. Brown said, “but this bill is nowhere near as good a deal as the one middle-class homeowners get under current law. Tax hikes and falling home prices are a one-two punch that homeowners simply can’t afford.”

According to NAR estimates, under current law homeowners in Alabama save an average of $1,798 through the mortgage interest deduction. Understandably, any changes that might significantly decrease those savings would be detrimental to the housing market in the state.

When asked about the proposed changes to the mortgage interest deduction, the state’s lone Democrat, U.S. Rep. Terri Sewell of Birmingham voiced her concerns about the bill.

“I oppose all Republican cuts to the mortgage interest deduction because it would have a chilling effect on home ownership—making it harder, in some areas, for families to own the home of their dreams,” Sewell said.

But Republicans in Congress expressed confidence that the bill would benefit middle-class families throughout Alabama and the country.

Yet while tax reform has been a long-sought goal by members on both sides of the political aisle, many congressional Republicans have acknowledged that the proposed bill is not yet perfect, and additional tweaks may be necessary to ensure that middle and lower-class citizens see an eased tax burden.

“This is going to be a process, and the bill released today is just a starting point,” Congressman Bradley Byrne (R-Fairhope) said Thursday. “We need to get this right, and I look forward to working with President Trump to do just that.”

As for the specifics of the housing market, much remains to be determined about how the proposed changes would affect middle-class homeowners.

“The housing market is complicated, and there are several factors that affect the value of homes and the amount of Americans buying houses,” said Senator Richard Shelby (R-Tuscaloosa). “Hardworking Americans deserve to take home more of their paychecks, and we are working to make that happen.”

For more information on the tax cut, please visit the website for the U.S. House Speaker Paul Ryan (R-Wisconsin).