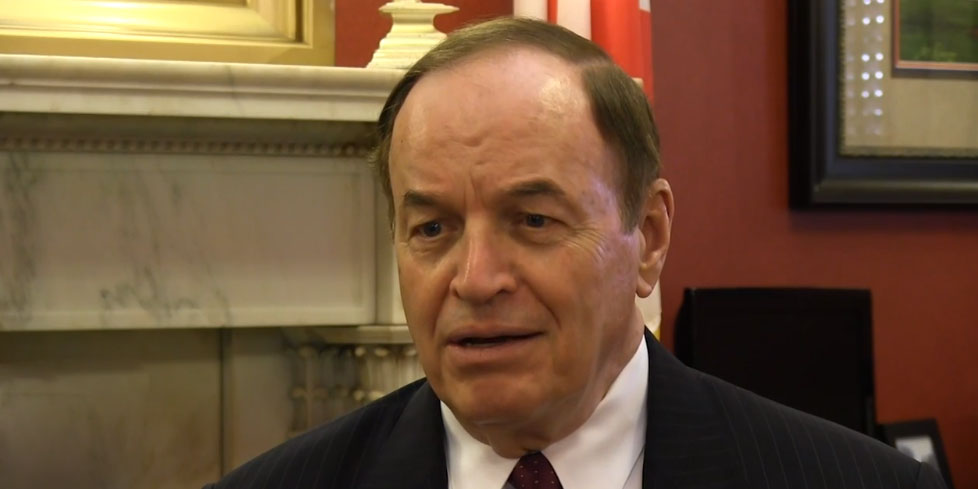

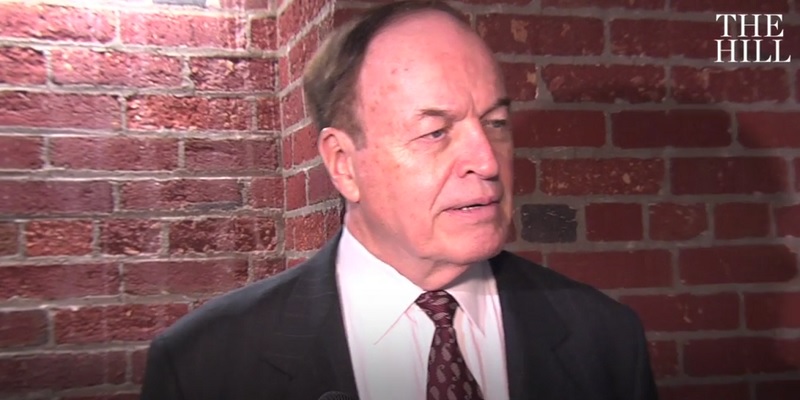

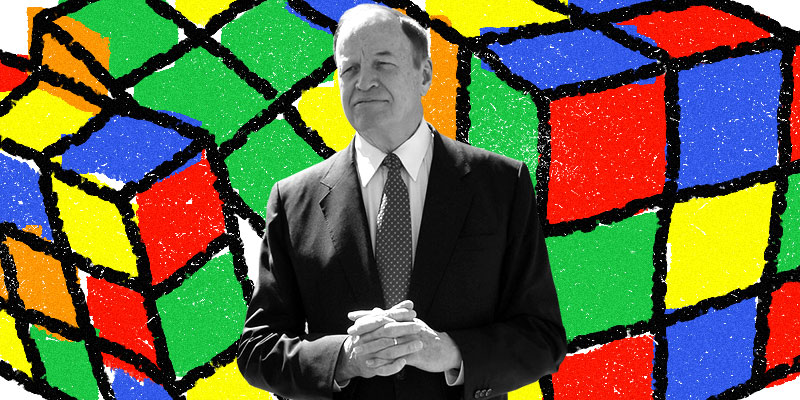

CAMBRIDGE, Mass. — During a guest lecture at Harvard University on Wednesday, Sen. Richard Shelby (R-Ala.) took aim at Dodd-Frank, the sweeping — many conservatives would say onerous — regulatory reform package passed by Democrats in response to the so-called “Great Recession.”

“I am leading an effort to address a number of concerns identified during the implementation of Dodd-Frank,” Shelby told Harvard students and faculty members in the university’s Program on International Financial Systems. “We now have better information on how financial regulation should be tailored to help prevent another crisis and reduce systemic risk. We also know where it should be pared back to provide relief to smaller and regional financial institutions, and where transparency and accountability are needed the most at regulatory agencies.”

After Republicans took control of the Senate in January, Shelby was installed as chairman of the Senate Banking Committee, positioning him to play a leading role in rolling back Democrats’ expansive financial regulations.

Shelby said Dodd-Frank has not only had a negative impact on the economy — and on community banks in particular — it has also simply not done what Democrats insisted it would: reform Wall Street.

“According to data published by the Chicago Federal Reserve Bank, the five-largest U.S. bank holding companies have grown by $638 billion since 2010,” Shelby explained. “(They) now account for 51 percent of total assets in the system.”

His remarks were met with nodding heads and knowing glances. A Harvard study released earlier this year concurred with Shelby’s findings. The study, which was published by Harvard’s Kennedy School of Business, concluded that Dodd-Frank’s “reforms” actually made the so called “too big to fail” banks even bigger.

“[W]e find that community banks emerged from the financial crisis with a market share 6 percent lower, but since the second quarter of 2010 – around the time of the passage of the Dodd-Frank Act – their share of U.S. commercial banking assets has declined at a rate almost double that between the second quarters of 2006 and 2010. Particularly troubling is community banks’ declining market share in several key lending markets, their decline in small business lending volume, and the disproportionate losses being realized by particularly small community banks.”

The regulatory burden created by Dodd-Frank is so great, according to a George Mason University study cited by Harvard, that one-third of the country’s community banks were suddenly made unprofitable. This has prompted countless mergers, further consolidating the banking industry and reducing consumer options.

Sen. Shelby bemoaned the law’s impact and laid the blame directly on its “thousands of pages of new, complex regulations and layers of new bureaucracy.” He also expressed frustration with the law having centralized regulatory authority among “unelected, unaccountable bureaucrats.”

Shelby was optimistic, though, that he would be able to rally support for change.

“Even some of Dodd-Frank’s original supporters are beginning to acknowledge that the law is not untouchable and that some changes should be made,” he said. “Our collective goal should be to establish a world class regulatory regime that preserves the safety and soundness of our financial system in the least restrictive manner so that we foster and support access to credit in an effort to encourage economic growth at all levels of our economy.”

.@SenShelby in @Harvard lecture blasts Dodd-Frank for crushing community banks, calls for changes http://t.co/4N96sOWNSq

— Cliff Sims (@Cliff_Sims) October 15, 2015