BIRMINGHAM, Ala. — According to a new study, Governor Bentley’s $0.82 tax increase on cigarettes could weaken economic growth, cause the government to become reliant on uncertain revenues, and unduly burden Alabama’s low-income earners.

The study, commissioned by the Phillip Morris Company but using data from the Center for Disease Control and Prevention (CDC) and the Tax Foundation, asserts that Alabama’s adult smokers already pay “their fair share,” and increasing the state’s “sin tax” on cigarettes would do more harm to the state government, and Alabamians, than good.

Here are the five reasons the study says the tax increase would harm Alabama:

1. Uncertain Revenue

Total state taxes paid on cigarette sales in Alabama have declined 2.4% a year for the last ten years. If this trend continues or accelerates, the Alabama government will collect less revenue from cigarette excise taxes over time and this will result in large funding gaps.2. Weakens Economic Growth

The historic economic crisis led to exceptionally high levels of unemployment and eliminated trillions of dollars of wealth from the American economy. Despite recent improvements, according to the U.S. Census, “in 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession.” Tax increases would weaken the already fragile economy by suppressing consumer spending, straining household budgets, and curbing retailer sales.3. Harms Retailers

According to the National Association of Convenience Stores, cigarettes are the top revenue generator, accounting for 31.8% of in-store sales nationwide. Increasing the excise tax could hurt legitimate retailers when adult smokers shift purchases across state lines or to other outlets, such as the internet. This would negatively affect Alabama’s 7,180 retailers.4. Burdens Low-Income Earners

Cigarette excise taxes are regressive because they most negatively affect lower-income adult smokers. Based on data from the Centers for Disease Control and Prevention, 34.0% of adults in Alabama who earn less than $15,000 are smokers, whereas only 13.6% of adults who earn $50,000 or more are smokers.

Raising taxes will unfairly further burden low-income earners.5. Increases Illegal Smuggling

An excise tax increase could provide incentives for smuggling and other contraband activities, resulting in lost tax revenues. In 2014, the Bureau of Alcohol, Tobacco, Firearms, and Explosives said “$7 billion to $10 billion in state and federal tax revenue is lost each year because of [cigarette] smuggling, up from $5 billion a few years ago…’”

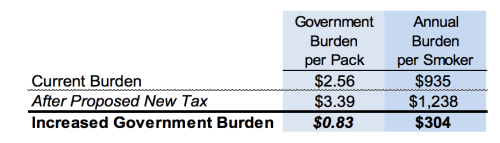

Increasing Alabama’s per-pack cigarette tax $0.82 to a total of $1.25 would require the pack-a-day smoker to pay an increased $304 a year, for a total tax burden of $1,238.

According to data from the CDC, Alabamians who earn $15,000 or less a year are 2.5 times more likely to be smokers than Alabamians who earn $50,000 annually.

In fiscal year 2014 alone, Alabama’s smokers paid $674.6 million in federal and state taxes on cigarettes. The state received $126.9 million of the revenue while state and local sales taxes and local excise taxes made up another $145.7 million. The rest is remitted to the federal government.

All of this adds up to the tax constituting an undue burden on low income smokers, according to the study. This heightened burden would divert money that would otherwise be spent on food, clothing, medical care, and other necessities from entering the private market.

Additionally, the study argues increasing the cost of cigarettes in Alabama would only push smokers to buy in neighboring states, where excise taxes will and prices will be lower.

“Alabama adult smokers could save $1.37 per pack or $501 annually by purchasing cigarettes in Georgia where the average price is only $5.10 per pack,” the study says. “As adult consumers shift purchases to other states, the government will collect less revenue than expected from a cigarette tax increase.”

The Governor made increasing the excise tax on cigarettes and tobacco a central part of his tax proposal, constituting a whopping $205 million of the $541 million plan, but the study suggests that such a large revenue increase projection is likely too good to be true.

The study emphasizes that revenue from excise taxes on cigarettes has declined 2.4% annually for the last decade, while government spending has increased at a clip of 3.6% per year over the same time period.

According to the study, 91% of tobacco excise taxes introduced between fiscal years 2009 and 2013 failed to live up to the revenue increases promised when they were instituted.

“If Alabama relies on a cigarette excise tax to fund government spending,” the study says, “it will create long-term funding shortfalls that will have to be paid for with other budget revenues or tax increases.”

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015