The Alabama Legislature is considering a new law instituting something called mandatory “combined reporting.” Proponents say the requirement would increase Alabama revenue by making out of state businesses pay their fair share. Here are five reasons this bill is a bad idea for the Yellowhammer State.

1. It’s a tax increase, one of the largest in Alabama’s history, and a government power grab that greatly expands the bureaucracy and authority of the Alabama Department of Revenue

First and foremost, let’s be clear. The issue known as Mandatory Unitary Combined Reporting (MUCR) is a tax increase. Plain. And. Simple. It is being sold as “closing corporate loopholes” on “out of state corporations.” In reality it is a tax increase on existing businesses in Alabama.

Most importantly, this is a tax increase on Alabama businesses that operate in more than one state, even those that are primarily based here, including those that are members of a group of related companies. The idea that it is just a tax on “out of state” corporations is not only misleading; it’s simply untrue!

Many policy makers in Alabama rightfully like to throw rocks at the federal government for its overreach in areas such as the EPA, IRS, and the Affordable Care Act. However, by supporting one of the largest and most complex taxing schemes in Alabama history, these Alabama policy makers who support combined reporting have forgotten their lessons on the value of limited government. Mandatory unitary combined reporting would give the Alabama Department of Revenue unprecedented authority to implement tax increases on businesses, creating much confusion in our already overcomplicated tax code and requiring the government to substantially expand its bureaucracy.

It’s ironic that at a time when we are talking about funding the essential functions of government, an idea would be put forward that expands government rather than streamlining it.

2. Adopting this tax increase would unilaterally disarm Alabama’s economic development team

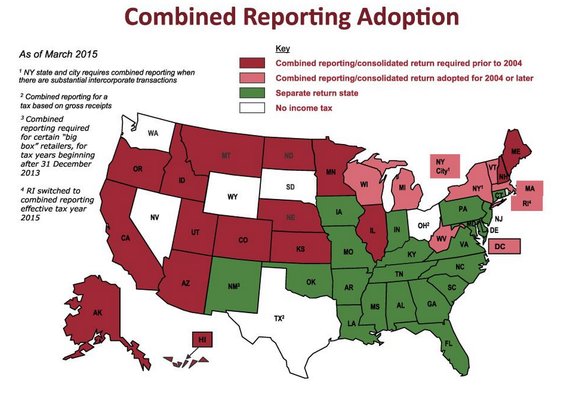

Imposing this tax increase inevitably would force those profitable companies looking to expand and locate here in Alabama to choose one of our competitor states that does not impose this method of taxation. There is a reason that no other state in the Southeast and less than half of all states have adopted MUCR.

In the hypercompetitive world of economic development and industry recruitment, instituting this new tax regime could bump Alabama back down to the minor leagues.

When a MUCR bill was recently introduced during the Legislature’s first special session, a business that was about to announce the creation of 350 new jobs and a $500 million capital investment in Birmingham stated that if Alabama adopted this tax increase, they would consider locating elsewhere.

The executive director of the Economic Development Association of Alabama, Jim Searcy, sent a letter to Alabama senators describing how this tax increase would devastate economic development in Alabama. “It would have a chilling effect on Alabama’s efforts to recruit new investment and jobs into the state, as well as, negatively impacting companies that currently operate in Alabama.”

3. This tax increase punishes the very businesses that have been creating jobs, growing our economy, and generating more revenues for state government

Let’s look back in time a moment. In a 2011 op-ed, Business Council of Alabama President and CEO William J. Canary stated that if we created jobs in this state, more revenues would be generated. For every 22,000 jobs created, conservatively $100 million is generated for government without ever increasing taxes. News flash, this has been happening!

Since 2010, nearly 90,000 private sector jobs have been created and tax collections have increased by more than $1 billion in that time. Government certainly didn’t create these jobs. The private sector did. And if government would get out of the way, the private sector could create even more jobs.

With all of the calls to raise taxes on the private sector to prop up government services, let’s recall that during the Great Recession, the private sector lost over 150,000 jobs in Alabama and we still have not fully recovered.

The private sector can continue to lead us out of the Great Recession, but not if the federal and state governments continue to enact policies that hinder economic growth.

4. This is a tax increase supported by the Alabama Education Association (AEA) for decades

The Alabama Education Association (AEA) promoted this tax increase year after year for more than a decade. The Legislature, even under Democratic control, rejected this major tax increase, clearing the way for major economic development projects such as Mercedes, Hyundai, Airbus, Austal, Raytheon, Remington, Honda, Google, and many more.

5. Alabama’s current law already addresses the issues some claim are loopholes

According to the executive director of the Council On State Taxation (COST), Doug Lindholm, “[t]he Department of Revenue currently has all the tools necessary to ensure that income is fairly reflected on separate state corporate income tax returns, including add-back statutes and well-established standards for arm’s length pricing.” Specifically, the legislature passed the add-back statute that addresses intangibles, interest expenses, and REIT dividends and authorized the revenue commissioner to use Internal Revenue Code section 482 powers.

Mr. Lindholm, referencing a COST study on MUCR, also noted that many companies are still recovering from the Great Recession and carrying forward net operating losses. Thus, the claim that nearly 60 percent of companies don’t pay income taxes is extremely misleading.

Additionally, in the most recent special session, the Alabama Legislature passed a significant tax reform measure known as Factor Presence Nexus. This is a new method for determining “nexus” for tax purposes for companies that do business in Alabama but may not have a physical presence in the state. The Legislature should first examine the effect of this new law rather than increasing taxes on Alabama businesses.

A different approach

Individuals, families, and businesses make long-term decisions based on a very complex tax code. Instead of increasing the complexity of the tax code in Alabama, we should instead be discussing ways to simplify it and even reduce tax rates so that Alabama businesses and families can invest and employ their capital. This is actually how the economy grows, rather than the government taking a bigger piece of the pie as many in Montgomery and Washington believe.

The business community continues to be more than willing to be part of a solution to address our state’s budget challenges. The “politics of division” seems to be a sport in Alabama. We need to put these divisive tactics behind us and focus on a future full of opportunity and promise for all Alabamians.

If you are interested in learning more about this tax increase and why it is bad for Alabama, visit this resource provided by the Business Associations’ Tax Coalition, a coalition of business groups representing nearly every sector of Alabama’s economy all of which oppose this tax increase.

Marty Abroms is the chairman of the Business Council of Alabama and the president of Abroms & Associates, P.C. in Florence.