I have never been a fan of the FAIR Tax idea on the federal level, and it seems to be like an even worse policy on the state level.

Sure, I want a simpler tax policy and would gladly take the FAIR Tax over the tiered system we have in place right now, but only because it isn’t as bad of a system.

The FAIR Tax includes a “prebate,” which is designed to keep people who aren’t paying taxes now from paying taxes if this passes. That doesn’t sound very “fair” to me. It sounds like, and is, a vote-buying scheme.

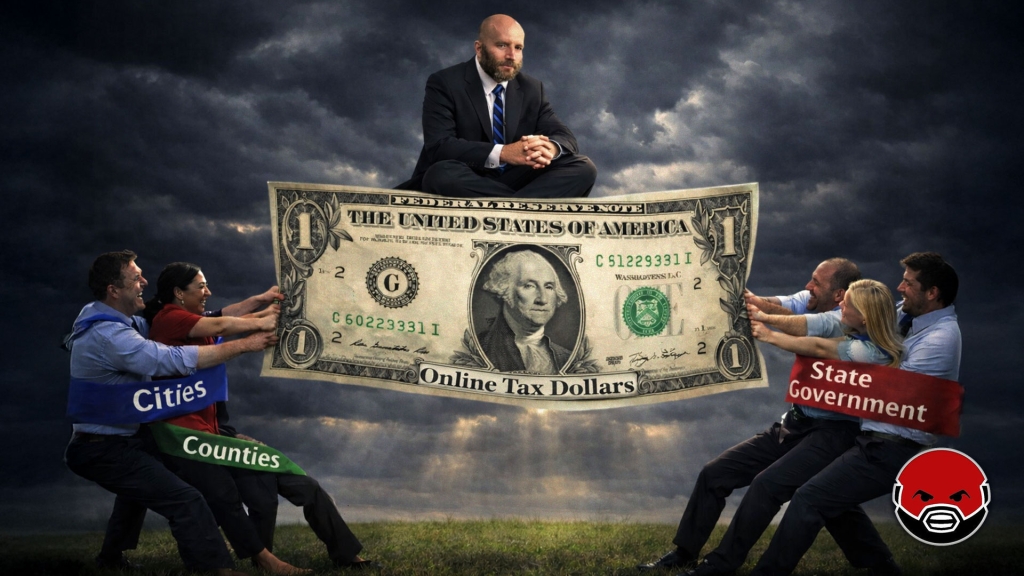

But the largest problem with the current bill proposed by State Rep. Mike Holmes (R-Wetumpka) is that it eliminates all local tax, which sounds like a good idea, but is actually a nightmare for individual cities and counties.

Local municipalities in Alabama, and elsewhere, choose how to fund their schools in addition to the federal and state monies they receive based on student population. They increase and decrease their tax rate and the local politicians suffer or flourish for those choices. The same is said for issues of roads and economic development as well.

Holmes acknowledged as much during a radio interview on WVNN Thursday morning that his plan would eliminate all of those taxes and create a single tax rate which divides the money collected by population. This eliminates a local school board’s ability to raise taxes as they see fit, which may seem like a win for anti-tax people, but it is a nightmare for municipalities that have placed a priority on these matters.

When pressed on this, Holmes suggested the code of his bill would be reworked to “recreate” the current rate of funding for municipalities with high tax rates as those with a lower rate but the rate of taxation will remain “fair.”

This “fix” means that a resident in Tanner and a resident in Selma will pay the same tax rate, however, Selma residents will receive more in return because their current rate is 10% while Tanner’s is 4%.

Selma would receive more than twice the disbursement per resident.

Does that sound “fair?”

Here is the “Dale Jackson Fair Tax” as could actually pass the legislature:

- Eliminate the prebate

- Leave the cities and counties alone

- Take the state’s income tax and convert it to a revenue-neutral sales tax rate

Taking Holmes’ 8.03% rate (this new number would be lower) and adding whatever the cities are already taxing at would at least keep the municipalities that are investing in their area.

But here, a Huntsville resident would end up paying 13.03% if they left their current rates alone.

| Alabama: | 8.03% |

| Madison County: | 0.5% |

| Huntsville: | 4.5% |

Good luck selling that to anyone.

Dale Jackson would oppose “The Dale Jackson Fair Tax.”

The correct answer for a better tax system will always be a flat tax where everyone pays the same percentage and everyone has skin in the game.

Listen:

Dale Jackson is a contributing writer to Yellowhammer News and hosts a talk show from 7-11 am weekdays on WVNN.