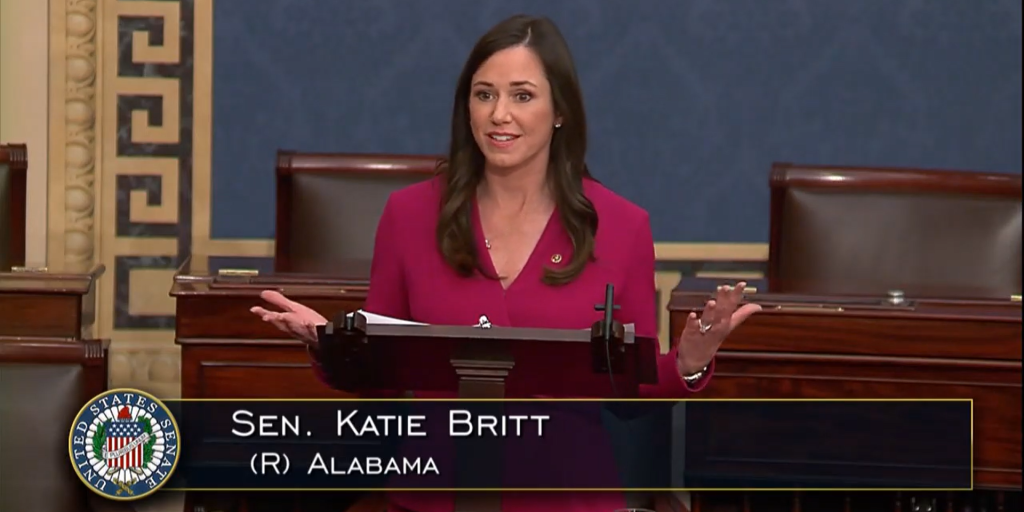

U.S. Senator Katie Britt introduced two bipartisan pieces of legislation, the Child Care Availability and Affordability Act and the Child Care Workforce Act, with the goal of making childcare more affordable and accessible by enhancing existing tax credits and increasing the supply of child care providers.

Sen. Britt (R-Montgomery) joined reporters on Wednesday morning to discuss a range of legislative topics. The Senator was first asked about two bills she recently helped to introduce that would make child care more affordable and accessible for millions of Americans, in turn aiding small businesses.

The Child Care Availability and Affordability Act and the Child Care Workforce Act, if passed, could achieve the Senator’s goal of reinforcing small businesses by strengthening existing tax credits to lower childcare costs and increase the supply of childcare providers.

“When we looked at this and looked at the currently existing tax code and kind of looked at different incentives, obviously there was an incentive for maybe larger manufacturers or businesses to start to move down this path,” said Britt. “We expand that for them from 150,000 to half a million dollars. We think that’s the kind of incentive that they need to really engage in this space in a meaningful way.”

RELATED: Working families set to benefit from Alabama childcare tax credit after approval from lawmakers

She understands the effort it takes to make a small business a success.

“Now, when it comes to small businesses, as the daughter of two small business owners, I know how challenging it is to make ends meet. I know that you’ve got workers. You need every worker in every place, and you’re really trying to not only allow your business to survive, but you want it to thrive.”

Britt also listed some startling numbers on the percentage of men and women who have to call out of work due to a lack of affordability and access to childcare.

“I think 76% of mothers had to miss work at some point during the year, obviously, because of that reason, and then also about 66% percent of fathers. So there’s a significant problem here in general. What we did here was we actually allow small businesses to pool together.”

The legislation has the potential to be a “game changer.”

“So we increased that tax credit for them to $600,000 and have allowed them to come together. And so if you were at a mom-and-pop coffee shop and across the street as a hardware store, and then down, too, is a bike shop, you can come together and pull those resources to take advantage of the incentives in this program.”

“That is new and that is exciting.”

According to Britt, the worsening child care crisis is holding families, child care workers, businesses, and the entire economy back. Over the last three decades, the cost of child care has increased by 220%, forcing families—and mothers, in particular—to make impossible choices. More than half of all families live in child care deserts.

Austen Shipley is a staff writer for Yellowhammer News. You can follow him on X @ShipleyAusten