Rapid advancements in Artificial Intelligence have drawn the attention of regulators.

From the Securities and Exchange and Federal Trade commissions to the White House and Pentagon, law enforcers and lawmakers are trying to get their arms around the global impacts of AI.

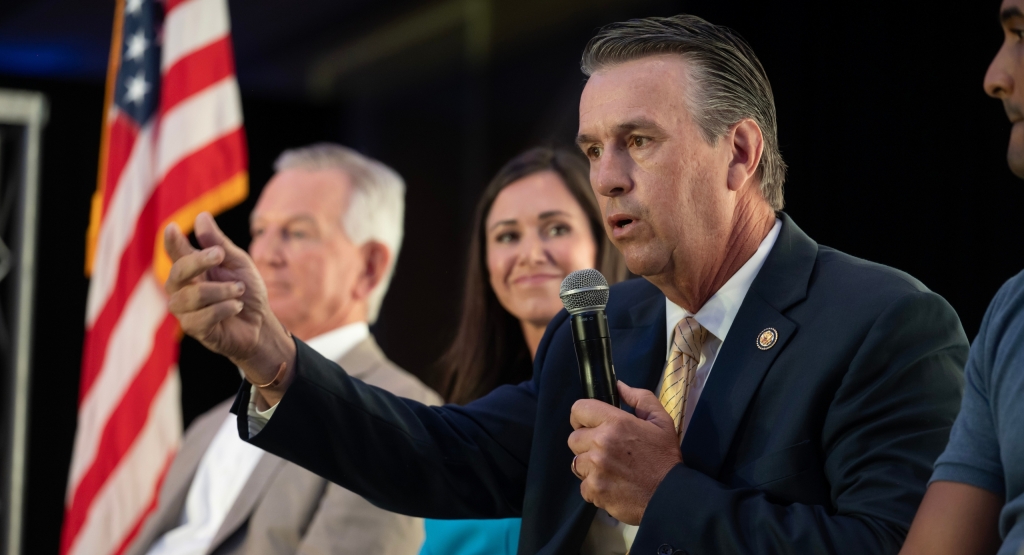

U.S. Sen. Katie Britt, Alabama’s voice on key financial issues in the upper chamber of Congress, got the chance to dissect the role of AI in business and banking during a hearing last week.

Britt (R-Montgomery) asked how companies can drive American innovation and dominance while guaranteeing protection of American consumers.

“For instance, in Alabama, we’ve seen examples of positive capabilities of AI and how it can help enable effective military operations. I am particularly proud of the work that goes on there in the defense and the intelligence community,” Britt said.

“There have been calls from some of my colleagues to what I believe amounts to overregulation of the industry. I believe, as legislators, we should take a more strategic look at this and be very thoughtful about how we approach a governance framework for any type of emerging technology, being sure that appropriate guardrails are in place that allow for innovation and enable positive use cases, while mitigating potential risk.”

The Department of Justice, FTC, and Consumer Financial Protection Bureau have announced an intention to “protect” the rights of Americans from the practice or manipulation of technologies like AI.

RELATED: Britt introduces legislation to increase oversight on US-China tech agreements

When it comes to detecting and stopping financial crime, Britt asked about the trade-off.

“How should we properly balance the strong capabilities of AI to help improve fraud detection and cybersecurity while managing the fact that these technologies can and have been used by bad actors?” she said.

Daniel Gorfine, a former government financial chief, said, “I think one of the more promising areas of artificial intelligence is in this reg tech space, regulatory technology. There’s incredible potential to, in terms of market surveillance, trade surveillance, that certainly capital market’s regulators are able to deploy.

“You know, on the flip side, absolutely, as we’ve always seen, criminals will use new tools and new technologies to engage in crime. You used a law enforcement approach. I was noting earlier the NSA, FBI, and CISA putting out thoughtful guidance on some of their research into deep fakes and scams, and it’s really important for that information sharing to take place,” he said.

Britt said the subject of the hearing directly impacts Alabama.

“And while it has received significant attention, only in recent weeks in Washington, D.C., many in the financial industry have been using this type of technology for years,” Britt said. ‘Not only have banks and insurers utilized these capabilities of AI and their underwriting practices and risk management, but you have also seen a history of mature AI governance that can be a model for other industries to use.”

Grayson Everett is the state and political editor for Yellowhammer News. You can follow him on Twitter @Grayson270