The negative impacts of ObamaCare just keep on coming as Alabamians are set to face another rate hike courtesy of President’s signature legislation. According the the Centers for Medicare & Medicaid services, Blue Cross Blue Shield of Alabama will be forced to increase rates by an average of 39 percent on individual plans offered through the ObamaCare marketplace. The tremendous increase will affect 160,000 Alabamians and 5 percent of BCBS members.

The rate increases are larger for plans that offer more coverage. The low coverage bronze plans will have increases around 26 percent, while the popular higher coverage silver plans are expected to go up close to 41 percent.

ObamaCare has essentially created an insurance monopoly in the state’s federal insurance exchanges. Because of the law’s stringent regulations limiting the profitability of insurance companies, BCBS will be the only individual insurer in the market since Humana and UnitedHealth have decided to leave Alabama.

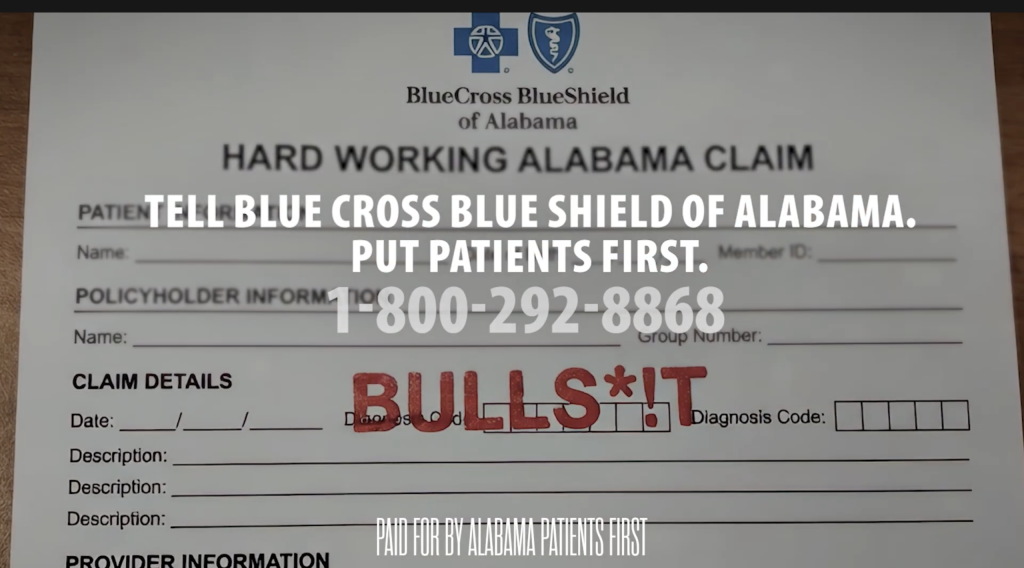

“The exiting of other insurers from the state is a clear indication of the difficulty in providing ACA health plans at the most affordable price without incurring significant financial losses,” Blue Cross Blue Shield of Alabama wrote in a statement.

But this rate hike is nothing new; it is just the latest occurrence in a new post-ObamaCare reality. Earlier this year, BCBS hiked rates by an average of 28 percent for individual plans to account for the tremendous losses created by the Federal Government. Because of the ObamaCare marketplace plans, the company lost more than $250 million from 2014 to 2016.

“The 2010 Affordable Care Act overhauled how health plans could be designed, priced and sold,” the Blue Cross statement said. “Blue Cross recognizes and regrets the impact these proposed rate increases will have on our ACA individual and small business customers. Though the ACA individual market is challenging at this time, we hope this market will eventually stabilize.”

President Obama’s sole legislative accomplishment was passed under the title of the “Affordable Care Act.” However, the law has seemingly failed to create affordability and care for those who actually need it.

The “affordability” aspect of the title has become downright laughable. The patterns of rate increases in Alabama are reflected across the country and are only set to get worse in 2017. The Blue Cross Blue Shield National Association released a report this March that claimed new enrollees under ObamaCare had 22 percent higher medical costs than people who received coverage through their employers. Overall, insurers ended up with a pool of enrollees smaller, sicker and costlier than they were promised.

Naturally, an influx of costs leads to a rise in premiums. After all, insurance is nothing more than a risk pool created to avoid detrimental costs to a single individual. But, according to the administration’s economists, this would not have been a problem if the pool was larger than it is currently. If young, healthy, premium-paying people would “buy-in” to the system, the overbearing costs brought in by those who had been uncovered or had preexisting conditions would be neutralized. But that did not happen.

For the umpteenth time in the history of global politics, the central planners were dead wrong. Young, single people did not buy-in and instead opted to pay the ObamaCare tax, made possible by the Justice Roberts Supreme Court.

In a 2015 report released by the Internal Revenue Service (IRS), 7.5 million taxpayers paid a tax for failing to have health insurance last year, as required by the ACA’s individual mandate. While the Obama administration only predicted 2 to 4 percent of taxpayers would make this choice, the ultimate number was closer 6, resulting in $1.5 billion in additional revenue for the Federal Government.

For the theory of shared risk to work, the uncovered healthy individuals are who the system needed to reach most. They would be the ones who could ultimately lower premiums. But right now, it is cheaper for most people in that situation to pay the tax than to buy a plan.

Almost six years after the law passed, it seems that it has clearly failed in achieving its critical goals. Now Alabamians are left to foot the bill.