MONTGOMERY, Ala. — Alabama’s District Attorneys are balking at budget cuts, but reforms to a controversial program could save the DAs, and taxpayers, millions a year.

Of Alabama’s 42 circuits represented by DAs, 34 of them also have what are called “Supernumerary District Attorneys,” or retired DAs who will practice in place of the circuit’s DA if he or she must recuse themselves from a case, or if there is an unmanageably high case load.

A supernumerary DA can be appointed after serving as a DA for 10 years, and must keep current on all continuing education and legal certifications for the position, but is awarded a hefty retirement salary, despite never contributing to the state’s judicial retirement system.

The current annual salary for a DA is $148,936, and the current salary for a supernumerary DA is about 75 percent of that, or $111,952 plus health insurance.

The state employs 51 supernumerary DAs as of October 2014, for a total cost the state’s general fund of $6.8 million, or nearly a quarter of the DA’s annual appropriations.

In 2012, the last time this program came up, legislative leadership said there was room for improvement, but no changes were made.

“We want to be fair and look across the Southeast and see what other states are offering their DAs,” said Senator Arthur Orr (R-Decatur), the General Fund budget committee chairman. “In any modern retirement benefits plan, it is incumbent on the participants to contribute a portion of their salary to that plan.”

House Speaker Mike Hubbard (R-Auburn) also indicated that changes needed to be made saying, “I believe the supernumerary system is flawed and needs to be addressed.”

DA offices facing budget cuts, however, are unable to do anything about the costs associated with the salaries of DAs and supernumerary DAs, as they are determined by state laws. Instead, each office’s budget must be shorn up through cuts to other positions or by finding revenues elsewhere. Some in Montgomery are suggesting they begin to rely more heavily on the work of supernumeraries whose salaries are taking up such a large part of their budget.

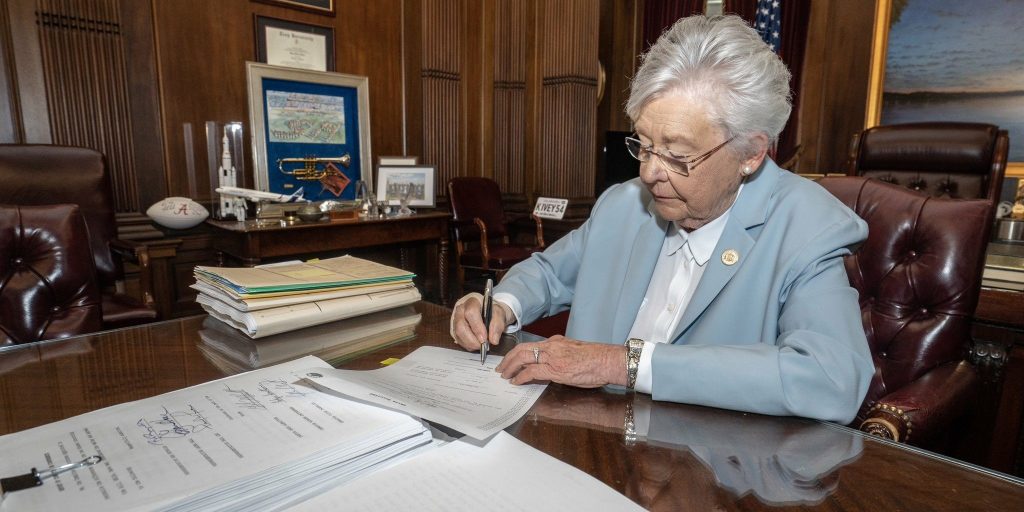

In other counties, DAs have pursued legislation this session that would levy an additional 5 percent tax on “spiritous wines and liquors.” Calhoun County was able to pass the tax, though it was originally vetoed by the governor who was concerned it violated Alabama law.

Revenues from the tax, about $300,000 annually, will go to the 7th circuit DA.

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015