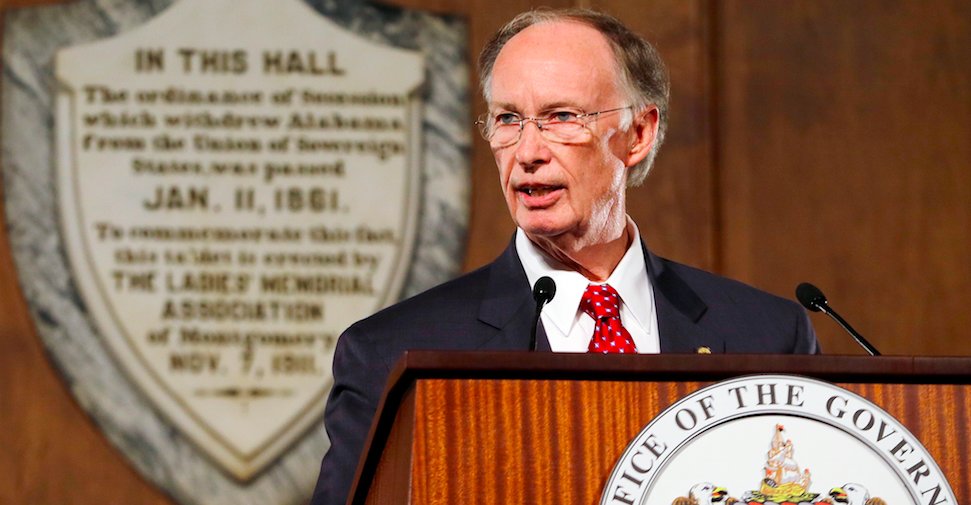

MONTGOMERY, Ala. — The Bentley Administration says the governor’s latest proposals will increase Alabamians’ taxes by $260 million annually.

Gov. Bentley on Thursday released details of his proposals for next week’s special session of the Alabama Legislature. In addition to several reform measures meant to address structural budgeting issues, the governor proposed three specific tax increases.

He is asking the legislature to increase the Business Privilege Tax, raise cigarette taxes and do away with the individual income tax deduction for FICA.

The FICA tax, or the Federal Insurance Contribution Act, is a 15.3 percent payroll tax split evenly between employees and employers. The revenues pay for Medicare and Social Security. Self-employed Alabamians pay the same 15.3 percent quarterly, meaning eliminating the deduction would hit many small business owners especially hard.

Alabama House Speaker Mike Hubbard last December summed up much of the opposition to eliminating the FICA deduction.

“I am opposed to removing the federal income tax deduction because it would basically require individuals to pay state taxes on their federal taxes, which is money they never even received,” he explained.

But eliminating the deduction is by far the largest part of Gov. Bentley’s latest proposal. Doing away with it would raise an estimated $182 million annually. Increasing the per-pack tax on cigarettes would raise $50 million, and increasing the business privilege tax would yield $28 million.

“Over the last few months, I have met with House and Senate members to discuss options and ideas that would prevent devastating cuts to state services,” Bentley said in a statement. “I look forward to working with lawmakers over the next few weeks to bring about real change in the way we fund state government moving forward.”

It is not possible to calculate the total potential tax increase in Bentley’s proposal because he included in his plan an open-ended call for “any other revenue measures that provide revenue for the General Fund.”

RELATED: The cigarette tax hike is a terrible idea, here’s why (opinion)

Conservative lawmakers have to this point beaten back all tax increase proposals, but State Rep. Ed Henry (R-Hartselle) said Wednesday the momentum seems to have shifted.

“I wish I could guarantee that taxes are off the table, that we had successfully beat back the tax push,” he said in an interview on Yellowhammer Radio. “There are a number of us that have laid our political lives on the line to stop taxes. We’ve done it for two sessions now. But I feel like the tide is starting to turn on us. They just keep coming back… I think they’re probably going to beat us this time… We’re going to fight with everything we have to stop it. But I feel like there are too many people in office right now who have succumbed to this idea that the government needs more of your hard-earned income.”

Henry said he expects Republican legislative leaders to push increases on the cigarette tax, the the business privilege tax and a Medicaid provider tax that would hit pharmacies and nursing homes.

“The tobacco tax probably annoys me (the most),” he said. “Today we’ll tax smokers. Next year we’ll tax alcohol drinkers…. This year we’re going after pharmacists and nursing homes. Next year it’ll be doctors. Then we’ll go after construction workers. But you never do a broad based tax because the people would vote you out of office… I’ve told my colleagues, if you really feel like we need more revenue, raise the sales tax one percent. That raises more than enough money and it effects every single person that lives here and does business here… If you really need money, do a sales tax. And guess what? We don’t really need money that bad.”

The legislature’s second special session of the year is set to begin Tuesday, Sept. 8. They will have 12 legislative days to pass a balanced budget before the current fiscal year ends Oct. 1.

Like this article? Hate it? Follow me on Twitter and let me know what you think.

— Cliff Sims (@Cliff_Sims) June 9, 2015