AUBURN, Ala. — A brand new Auburn University study reveals that regulatory uncertainty and cyber attacks are the chief threats to Alabama’s large banking industry.

The report released by faculty in Auburn’s Raymond J. Harbert College of Business examines the condition and performance of the state’s banks and offers policy suggestions aimed at helping state banks better serve their customers.

The study found that a whopping 88 percent of state bankers consider “regulatory burden” to be the biggest threat to their business model. “Political and regulatory uncertainty” were cited by 78 percent of respondents as a “major impediment” to operations and performance. The study’s co-authors say the banking industry is still coping with “a triple whammy: the impacts of the financial crisis on credit, the juggernaut of regulatory reforms and competition in a field that reinvents itself at breathtaking speed.”

“We had major regulatory action in 2010 with Dodd-Frank and bankers have been bemoaning that ever since,” said John S. Jahera, a professor of finance and a co-author of the study. “From the bankers’ point of view, it added a lot of cost in terms of regulatory compliance.”

Seventy-three percent of bankers reported that their primary competitive threat comes from “non-bank” financial firms, which are subject to fewer regulations, while 70 percent of respondents view vulnerability to cyber attacks as a “serious concern.”

The researchers suggests an overall easing of regulations to enable banks to serve “underbanked or non-banked” consumers through short-term loans at lower rates than those offered by payday lenders. They also proposed that the “harmful effects” of the Dodd-Frank Wall Street Reform and Consumer Protection Act be examined in view of the fact that recent regulations have increased costs for banks but not revenues. The researchers also called for the state Department of Banking to explore options to ease regulatory burden and associated costs for state-chartered banks.

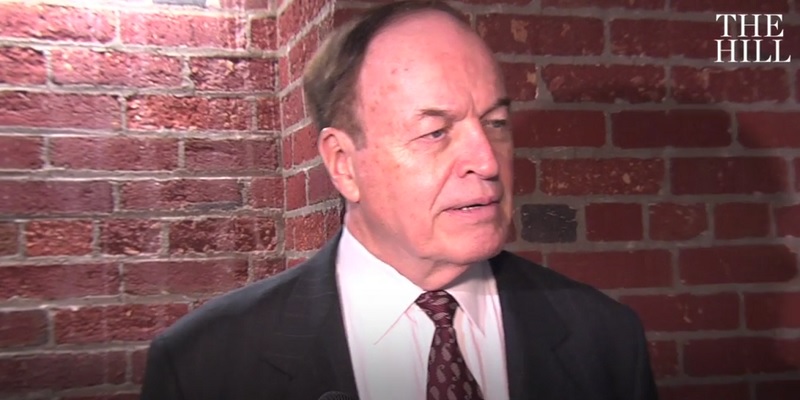

The recently re-elected Senator Richard Shelby (R-Ala.) has expressed desire to dig into Dodd-Frank and start calling out some of the more egregious regulations that have been imposed on the U.S. financial sector, all concerns expressed explicitly by the banks in the Auburn study.

RELATED: Shelby in Harvard lecture blasts Dodd-Frank for crushing community banks, calls for changes

“I am leading an effort to address a number of concerns identified during the implementation of Dodd-Frank,” Shelby said in a speech at Harvard University last year. “We now have better information on how financial regulation should be tailored to help prevent another crisis and reduce systemic risk. We also know where it should be pared back to provide relief to smaller and regional financial institutions, and where transparency and accountability are needed the most at regulatory agencies.”

After Republicans took control of the Senate in January of 2015, Shelby was installed as chairman of the Senate Banking Committee, positioning him to play a leading role in rolling back Democrats’ expansive financial regulations.

Shelby said Dodd-Frank has not only had a negative impact on the economy — and on community banks in particular — it has also simply not done what Democrats insisted it would: reform Wall Street.

“According to data published by the Chicago Federal Reserve Bank, the five-largest U.S. bank holding companies have grown by $638 billion since 2010,” Shelby explained. “(They) now account for 51 percent of total assets in the system.”

The regulatory burden created by Dodd-Frank is so great, according to a George Mason University study, that one-third of the country’s community banks were suddenly made unprofitable. This has prompted countless mergers, further consolidating the banking industry and reducing consumer options.

Sen. Shelby bemoaned the law’s impact and laid the blame directly on its “thousands of pages of new, complex regulations and layers of new bureaucracy.” He also expressed frustration with the law having centralized regulatory authority among “unelected, unaccountable bureaucrats.”

Shelby was optimistic, though, that he would be able to rally support for change.

“Even some of Dodd-Frank’s original supporters are beginning to acknowledge that the law is not untouchable and that some changes should be made,” he said. “Our collective goal should be to establish a world class regulatory regime that preserves the safety and soundness of our financial system in the least restrictive manner so that we foster and support access to credit in an effort to encourage economic growth at all levels of our economy.”