Inflation exceeded 5% in June. Double-digit inflation burdened Americans in the 1970s. Although we treat inflation as bad, economists find its costs hard to pin down.

The three economic functions of money help us think about inflation’s costs. Money’s first role is a medium of exchange, meaning a good way to conduct transactions. With barter, if you have oranges and want potatoes, you must find someone with potatoes who wants oranges. The second role is a store of value, or a way to avoid your oranges spoiling before you buy potatoes. Finally, money is a unit of account, or a convenient way to express prices.

A pure inflation means proportional increases in all prices, including wages and salaries. Consequently, inflation should not make households poorer since incomes should go up about the same as expenses. Any stress on budgets should be temporary, due to some prices rising before wages.

Rising prices reduce the dollar’s purchasing power, impairing money as a store of value. Suppose you plan to use $500 from a garage sale in August to buy Christmas presents. If the dollar loses half its value by Christmas, it is as if half your garage sale proceeds were stolen.

This is a cost, but a modest one for inflation of five or 10%. Many assets besides money provide stores of value and earn interest or capital gains to offset inflation, so people should limit how long they hold cash. Do not put your savings in a mattress during inflation.

Trying to hold as little cash as possible produces “shoe leather” costs, called this because in the 1970s depositing or withdrawing cash required trips to the bank. Prior to deregulation, banks were open limited hours. Electronic banking has dramatically reduced shoe leather costs.

Money still works as a medium of exchange with modest inflation because people can shift dollars into other assets after trading. Money stops working with extremely high levels of inflation, say thousands or millions of percent a year. This is called hyperinflation and is enormously costly; economists do not question the costs of hyperinflation.

Changing prices can also be costly. Economists refer to these as menu costs, from the case of a restaurant having to print new menus when increasing prices. Restaurants will raise prices more frequently with 12% inflation than 2%. Yet menu costs have fallen sharply with electronically posted prices.

Several other costs exist but also seem to be small. One potentially significant cost exists, related to long term contracts. Inflation benefits borrowers and hurts lenders. Fixed interest rate mortgages provide an example. My parents bought the home I grew up in in 1962 with a mortgage from a savings and loan. After inflation averaged 7.5% in the 1970s, my parents’ mortgage payments were, adjusting for inflation, only a fraction of what the lender expected to receive. The 1970s inflation ruined the savings and loans even though most did not go bankrupt until the 1980s.

Do we finally have a significant cost of inflation? Not necessarily. The wealth transfers result from contracts using nominal (or not adjusted for inflation) interest rates or wages. Economic theory predicts, and the evidence bears out, that nominal interest rates should be set based on the rate of inflation expected over the term of the loan. Accurately forecasting inflation can limit the wealth transfers, although forecasting is itself costly.

But an even simpler fix exists: adjust the contracted interest rate using observed inflation. Make a mortgage interest rate be, say, 3% plus the inflation rate in the previous year. We began adjusting many contracts for inflation after the 1970s; Congress even began indexing income tax brackets to eliminate “bracket creep.”

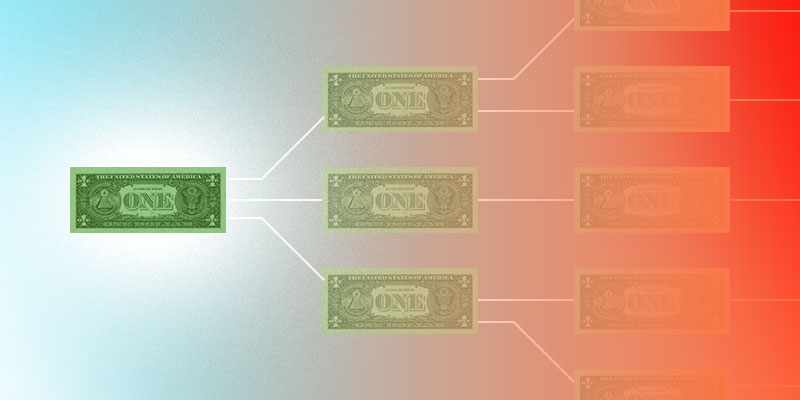

The costs of a modest inflation are normally small, and indexing contracts limits them further. The problem with inflation may be moral more than economic. To obtain money legally, people must either work or sell something of value. Counterfeiters do not earn their fake dollars, yet undetected counterfeit bills compete with ours to buy goods and services. Government-created money is like counterfeiting, and government should not be in the counterfeiting business.

Daniel Sutter is the Charles G. Koch Professor of Economics with the Manuel H. Johnson Center for Political Economy at Troy University and host of Econversations on TrojanVision. The opinions expressed in this column are the author’s and do not necessarily reflect the views of Troy University.