The Alabama legislature kicked off its new term with a special session to increase the gas tax, a result which seemed foreordained. Nonetheless, the gas tax raises interesting economic and political considerations.

Our gas tax is currently just under 21 cents a gallon, which ranks 41st nationally according to the Tax Foundation, or 36th if we adjust for state hourly wages. Pennsylvania has the highest gas tax at nearly 59 cents a gallon, and eight other states have taxes in excess of 40 cents. The proposed 10 cent increase over three years would put our tax 23rd, 17th when adjusted for income.

Over eighty percent of Alabama’s tax revenues are earmarked for specific purposes, the most of any state. The gas tax is dedicated for highways, so the new revenues should go to road improvements. Revenue sharing will allow counties to repair their roads as well.

Alabama has many roads and bridges needing repairs. According to the Federal Highway Administration, we had 1,200 structurally deficient bridges at the end of 2017. I can’t say exactly what this means, but structurally deficient doesn’t sound like a compliment.

An earmarked gas tax functions as a user fee, which implements the “benefit principle” of taxation. Citizens who benefit the most from roads will pay a larger share of the cost of repairs. The Tax Foundation, which generally opposes taxes, likes gas taxes: “Because they adhere to the benefit principle, gas taxes … are the revenue tools most suitable for generating the funds needed to maintain and repair public roads over time.”

Unfortunately, lower-income families spend relatively more on gas, making the gas tax regressive. This means that lower-income households pay a higher percentage of income in taxes. The gas tax does poorly on the ability to pay principle of taxation. This would not be as problematic if Alabama did not rely on regressive sales taxes for so much state and local tax revenue.

The failure to invest adequately in roads costs our state and nation. Twenty one percent of highways nationally have poor pavement condition, which costs Americans $120 billion annually in added repair costs, or over $500 per driver. Traffic congestion costs Americans another $160 billion in lost time and wasted gas. Forty percent of urban interstate highways are congested. Congestion is arguably due to a failure to expand road capacity.

Despite our low gas tax, Alabama’s roads and bridges are not, relatively speaking, in poor shape. Seven percent of our bridges are structurally deficient, which ranks 30th among states, and only two percent of our highways have poor pavement condition.

Is a tax increase truly necessary to maintain our roads? The general wastefulness of government, like the Pentagon spending $4.6 million in lobster and crab in one month for military contractors, probably gives many Alabamians pause. If Washington, Montgomery, and our cities and counties spent our tax dollars wisely, they’d probably have enough money to fix our roads.

While we should never tolerate government waste, waste is unavoidable because costs are very hard to assess. We also place many legal requirements on government contractors, increasing costs. Government waste does not change the reality that road maintenance requires resources. If we wait to eliminate all government waste before approving new taxes, our bridges and roads will likely have crumbled.

Unwillingness to pay taxes can lead states to seek alternative revenues. You’ve probably seen signs along roads warning of damaged guardrails. Tennessee bills drivers who damage guardrails in accidents to avoid spending tax dollars. This policy led to the family of a teenage girl killed in 2016 when her car hit a median guardrail being billed $3,000 for repairs. We may not like taxes, but alternatives can be more offensive.

Alabama has some of the lowest state and local taxes, so perhaps we shouldn’t complain about the gas tax hike. I would suggest that fiscal conservatives must also ask government to do less for us. Limited government does not mean big government on the cheap.

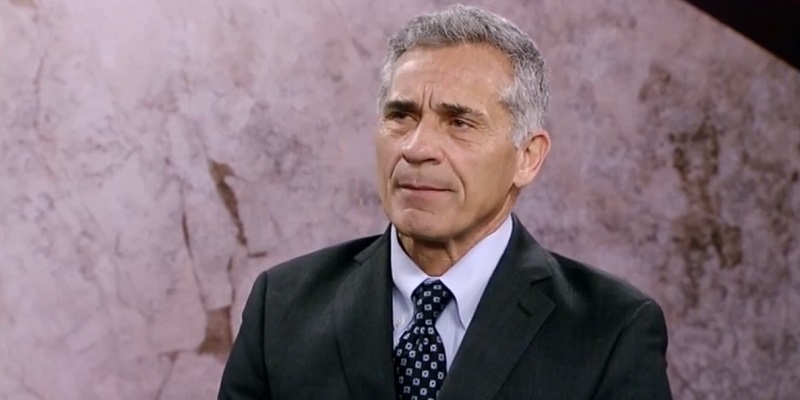

Daniel Sutter is the Charles G. Koch Professor of Economics with the Manuel H. Johnson Center for Political Economy at Troy University and host of Econversations on TrojanVision. The opinions expressed in this column are the author’s and do not necessarily reflect the views of Troy University.