At a speech given in Indiana on Wednesday, President Trump announced his administration’s plan for sweeping tax reform across all income brackets. According to the GOP, the new tax plan was created with three major goals in mind: more jobs, fairer taxes, and bigger paychecks. Republicans plan to do this by lowering tax rates for businesses both large and small, eliminating special-interest loopholes in the current tax code, and cutting excessive and costly taxes on individuals.

Some highlights of the GOP’s plan for tax reform include:

- Lowers rates for individuals and families by shrinking the seven current tax brackets into three: 12%, 25%, and 35%

- Doubles the standard deduction and increases the Child Tax Credit so that families can keep more of their paychecks

- Repeals unfair taxes such as the Death Tax and the Alternative Minimum Tax

- Limits the maximum tax rate for small businesses to 25%, and lowers the corporate tax rate to 20%

- Allows businesses to write off the cost of new investments for a period of five years

Republicans believe that this reform is what the nation needs to rid ourselves of the current burdensome tax code. In fact, Republicans have even included 31 reasons why we need tax reform in their plan.

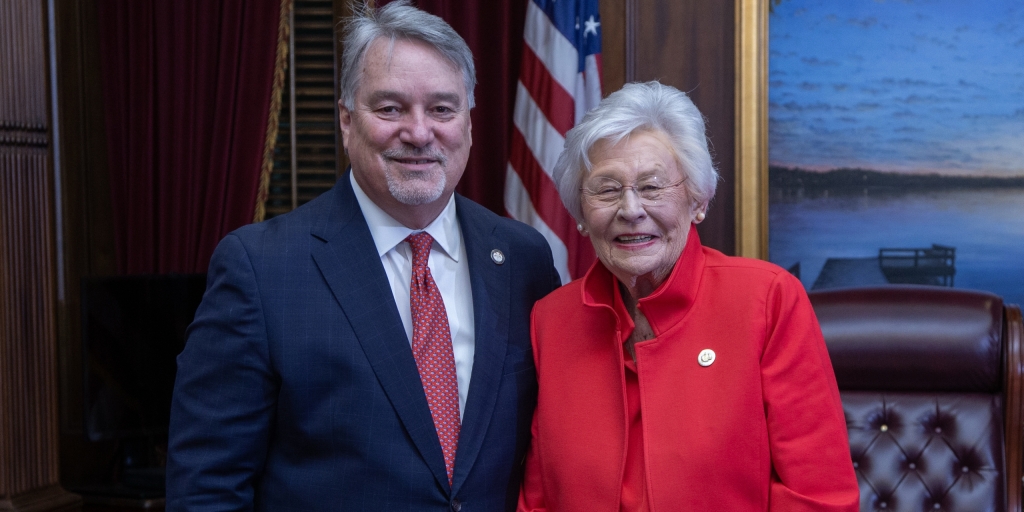

Immediately following the President’s announcement, the Alabama delegation made their support of the plan known. Congressman Mike Rogers believes that this reform is a much-needed shot in the arm to the American economy. In a press release, he stated, “I strongly support the tax reform framework outlined today by President Trump and the House Republican Leadership. Tax reform is the single best way to grow our economy. Hard working Americans are due a fairer and simpler tax code.”

Representative Bradley Byrne stressed the urgency of-of getting tax reform through Congress saying, “I am committed to joining with President Trump to advance real tax reform before the end of the year. Now is the time to fix our broken tax code, and we must get the job done.”

Representative Martha Roby took to Twitter to highlight the importance of putting the American people first when it comes to tax reform. “When it comes to using money wisely to take care of everyday needs, I trust the people far more than I trust the government,” Roby said.

Major tax reform could be the measure that sends Alabama’s already growing economy through the roof. The Yellowhammer state has seen some of its lowest unemployment rates in a decade, and manufacturing and textile companies continue to invest billions of dollars in the state and its workers. A simpler tax code just might let hard-working Alabamians keep more of their paycheck and have more money in their pockets.

Related: Expert Tax Attorney On What Trump Tax Plan Will Mean for You