Margaret Bradford, a graduate student in accounting at the University of South Alabama, looks forward to tax season.

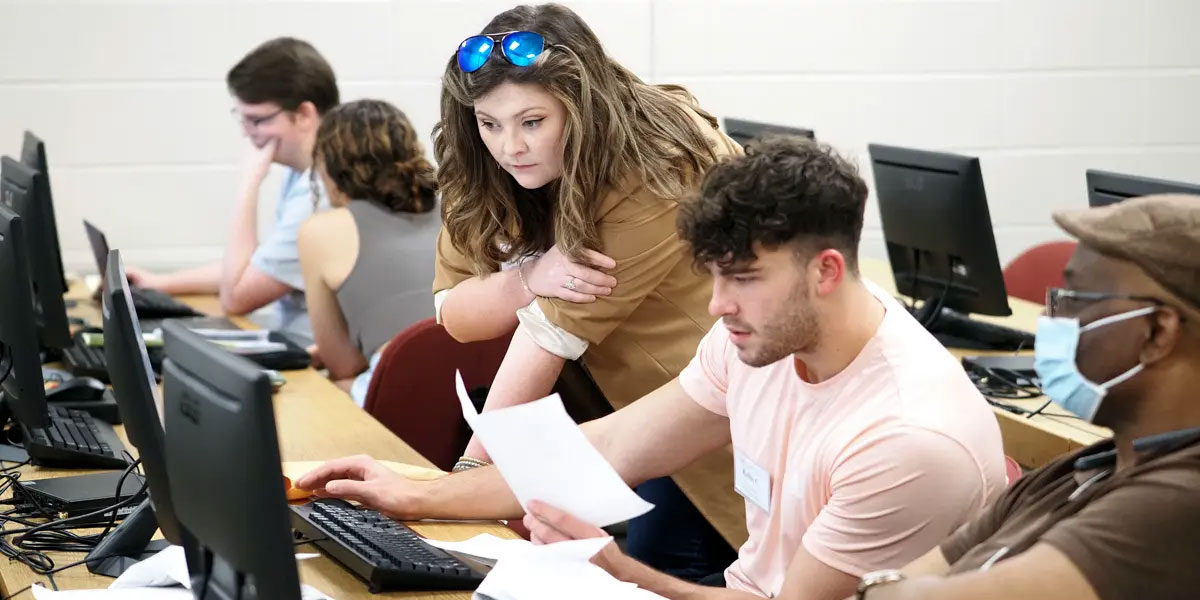

That’s when she and other students help people file electronic tax returns. They’re part of a nationwide program called VITA, Volunteer Income Tax Assistance. Students gain accounting experience, while clients get free help with their forms.

Bradford, the site coordinator for VITA at South, remembers helping a fellow student during her first year.

“When I told she would be getting back $500, she just started crying,” Bradford said. “She was working her way through school, doing three jobs, and she told me that money meant she wouldn’t have to pick up any extra shifts during final exams to pay her bills.

“That’s when I fell in love with this program. When you go into accounting, you don’t always think it’ll make a difference, but you can, in a small way.”

The University VITA program, funded with Internal Revenue Service grants, is open to anyone who earns less than $73,000 a year. It usually takes about 90 minutes for people to fill out a standard 1040 tax return, then have it double- and triple-checked by accounting majors.

The first South clients on Feb. 1 were James and Beverly Donald, a retired couple from Mobile. This was their third year of getting their taxes done through VITA.

Beverly Donald learned about the volunteer program when she worked in bookkeeping for USA Health at the Strada Patient Care Center.

“I was glad I found it,” Beverly said. “Before we came here, we were paying to get it done.”

The Donalds chatted with Bradford while their tax returns were prepared. She remembered them from last year, and the year before that.

Bradford apologized for taking so long to check their information: “I just want to make sure it’s perfect.”

The Donalds laughed.

“We’re retired, so we have plenty of time,” James said. “We’re free as a bird.”

VITA was founded in 1971 by Gary Iskowitz, a West Coast college instructor and former IRS agent. Over the last half-century, the program has expanded to several thousand sites across the nation.

VITA came to Mobile in 2008. Dr. Russ Hardin, interim chair of the accounting department in the Mitchell College of Business, encouraged students to volunteer with an organization that operated out of the Mobile Public Library.

South began its own VITA site in 2016. Two years later, the program had its busiest year with students preparing more than 100 tax returns.

“It provides a great service,” Hardin said, “and of course it helps our students gain experience. We let students run the whole VITA site.”

Businesses that prepare tax returns often charge $200 to $400 for the service. Many forms are simple, though each case is different, and finances vary.

“With elderly people, it does get a little complicated, with retirement benefits and donations to charity,” Bradford said. “So that’s great experience for our students.”

Bradford grew up in Clarke County, Alabama, where her father owns a sand and gravel company. Working for the family business helped her decide to study accounting in Mobile.

“It’s something I understand, something I’m good at,” Bradford said. “It’s like my second language.”

Tax Season

Students started preparing returns on Feb. 1 and will continue through April 15.

They meet with clients in Room 147 at the Mitchell College of Business. Hours are 2 to 5 p.m. Mondays, 2:30 to 5:30 p.m. on Wednesdays, and 10 a.m. to 2 p.m. on Saturdays. Appointments are encouraged, but walk-ins are accepted for open spots.

Clients must bring with them any W-2, W-4 or 1099 tax forms they’ve received from the federal government. For more information or to schedule an appointment, visit South’s VITA program online.