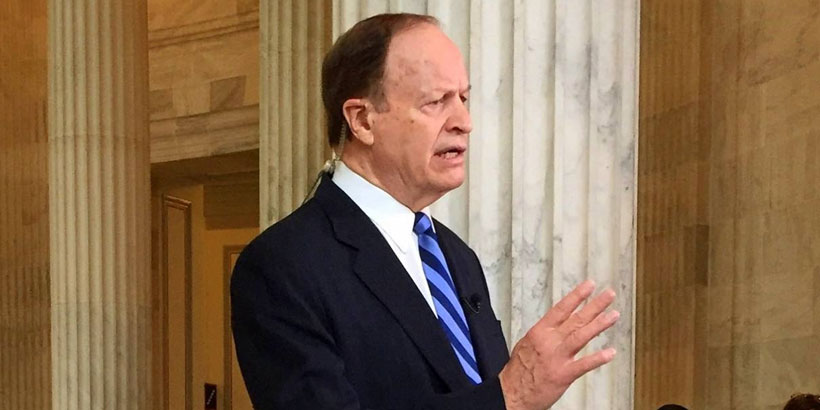

WASHINGTON — US Senator Richard Shelby (R-Ala.) on Tuesday indicated that he plans to use his position as Chairman of the Senate Banking Committee to roll back regulations on community banks and credit unions across the nation.

“Today we will focus on regulatory relief for smaller financial institutions,” Shelby said during a Banking Committee hearing. “In the near future we will continue this examination by focusing on unnecessary statutory and regulatory impediments across the financial services spectrum.”

Shelby said he believes reforming regulations on small financial institutions is a bipartisan issue, with both sides acknowledging there are improvements to be made to the 2010 Dodd-Frank Act, which placed heavy regulations on most financial institutions.

“Although we may not agree on many things,” he said, “I believe that we can all agree that community banks and credit unions play a vital role in our local economies.”

According to Alabama’s senior Senator, there are 629 counties in the US that are served by only one community bank.

“Six million U.S. residents depend on small financial institutions for their daily banking needs,” Shelby said. “These financial institutions use their knowledge of local communities to lend to small businesses, which are the engine of job creation in America.”

Community banks provide 48% of small business loans issued by US banks overall, and 52% of small business and farm loans issued in rural areas.

“These financial institutions are able to forge relationships with local consumers that enable them to develop products tailored to the specific needs of their communities,” Shelby said. “Unfortunately, we have heard that innovation tailored for Main Street is being smothered by unnecessary regulations originally designed for Wall Street.”

Shelby argued smaller banks should not be under the same regulations that are placed on larger banks. Smaller banks did not cause the financial crisis, he said, also adding that regulations cause small banks and credit unions to use resources on compliance instead of lending to local businesses and farms.

According to the Federal Reserve and the Conference of State Bank Supervisors, the Dodd-Frank Act caused compliance costs to increase for 94 percent of community banks.

“It is time to reverse this trend,” Sen. Shelby said.

A Harvard study also showed community banks with less than $10 billion in assets are losing market share at twice the rate they were before the financial crisis.

Many of the 115 banks headquartered in Alabama fall under the definition of community bank, and would benefit from reduced regulations.

“Past Committee hearings on this issue have demonstrated bipartisan understanding that something must be done in this area,” Sen. Shelby concluded. “Discussion today will build upon those efforts by providing specific recommendations for both regulators and Congress to implement. I believe that we are long overdue for regulatory relief for small financial institutions.”

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015