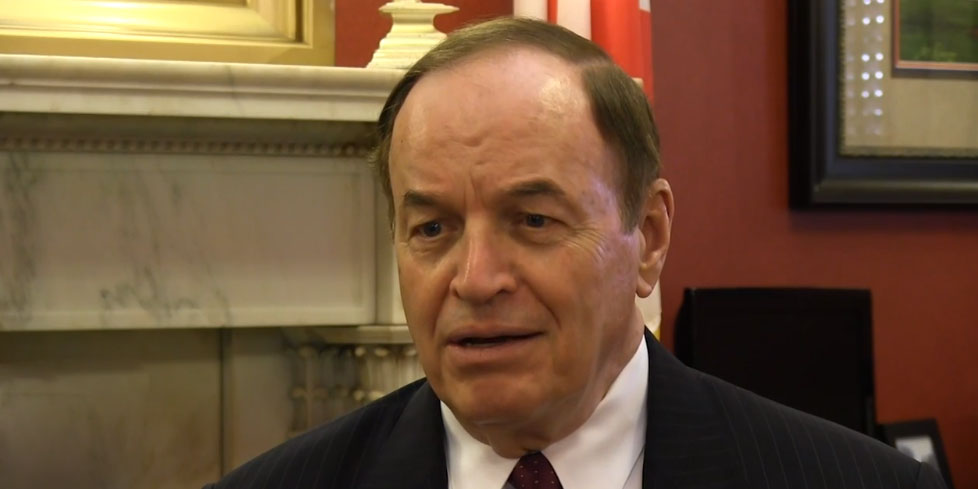

WASHINGTON — Senator Richard Shelby (R-AL) told Yellowhammer Tuesday that he thinks “It is time to put an end” to the controversial Export-Import bank, a major development due to Shelby’s position as chairman of the powerful Senate Banking Committee.

The Ex-Im bank, which requires Congressional reauthorization, will expire unless it is renewed by June 30th.

The bank has received vocal support from many business groups, including the U.S. Chamber of Commerce, but some conservative organizations, including The Heritage Foundation’s political arm Heritage Action, have waged a campaign against it, calling it the epitome of corporate welfare.

The Ex-Im Bank finances exports for American companies that would be too risky for traditional lenders by making guaranteed loans to the foreign purchasers of those exports. While the bank’s charter mandates at least 20 percent its outlays benefit small businesses, that rule has been frequently violated.

In 2013 76 percent of the bank’s spending went to its top ten beneficiaries. That year Boeing, the largest beneficiary of the bank for several years, received $8.3 billion in aid from the guaranteed loans taken out by the purchasers of their exports.

“After years of efforts to reform the Ex-Im Bank, it has become clear to me that its problems are beyond repair and that the Bank’s expiration is in the best interest of American taxpayers,” Sen. Shelby told Yellowhammer Tuesday afternoon. “Nearly 99% of all American exports are financed without the Ex-Im Bank, which demonstrates that subsidies are more about corporate welfare than advancing our economy.”

In denying Ex-Im reauthorization his support, Shelby finds himself in the rare position of being on the opposite side of an issue from many top executives in the business community.

“The Ex-Im Bank plays a significant role in Alabama’s job creation efforts. More than 80 Alabama-based exporters in various industries including forest products, chemicals, transportation and fabricated metal products have used the agency when private-sector banks could not help,”

BCA president William J. Canary wrote in an op-ed published in Yellowhammer last month.

In a hearing by the Senate Banking Committeelast week, the Senator expressed his disappointment in the bank’s progress on the accountability reforms recommended by the Government Accountability Office in 2012.

“After years of efforts to reform the Bank, I am not convinced that it has made enough progress to warrant a long-term reauthorization,” Shelby said during the hearing. “Taxpayers should not be compelled to once again stand behind the Bank if the problems are impossible to fix.”

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015