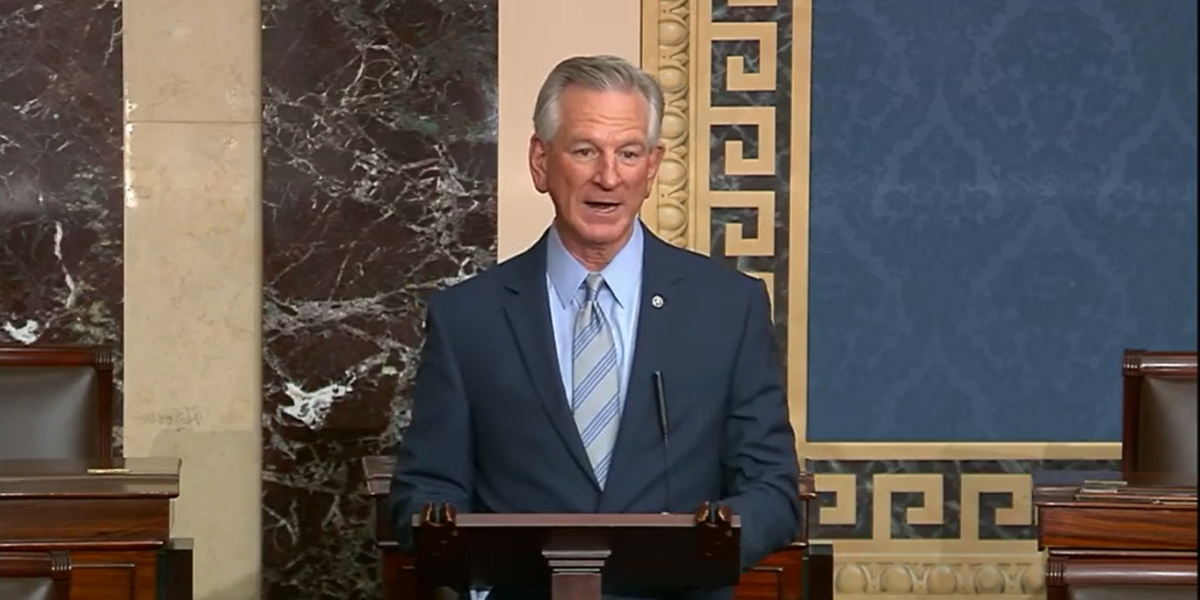

Senate Democrats on Thursday blocked U.S. Sen. Tommy Tuberville’s (R-AL) effort to pass his bill, the “Protecting Financial Privacy Act,” which would prohibit a controversial Internal Revenue Service (IRS) proposal to monitor banking activity consisting of $600 or greater from going into effect.

Presently, the requirement for financial institutions to report banking transactions to the federal government, via a Currency Transaction Report (CTR), sits at any cash amount greater than $10,000. The new proposal from the Biden administration drastically lowers the threshold and would also extend to non-cash transactions.

Should the proposal become official IRS policy, financial institutions would be forced to report Americans’ transactions under the new threshold to the U.S. Treasury Department’s Financial Crimes Enforcement Network.

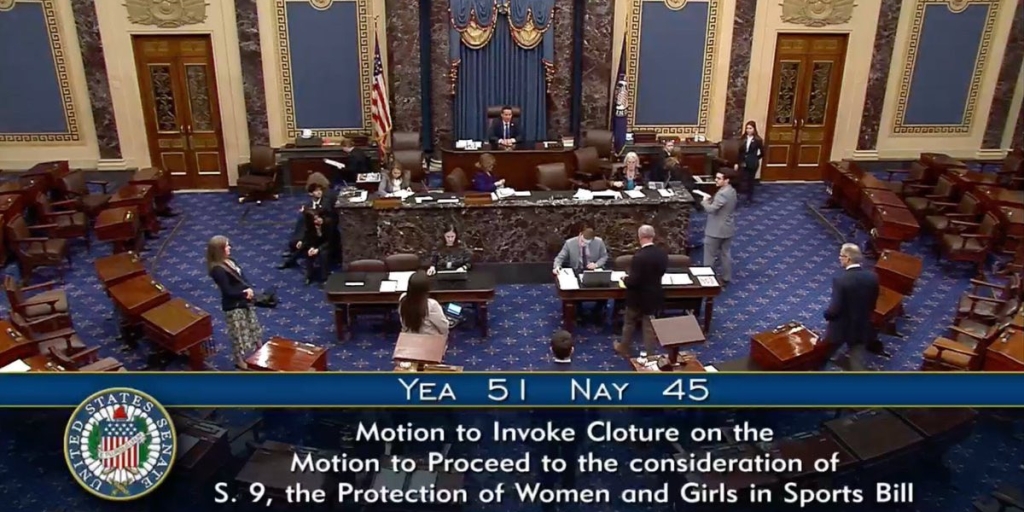

Senate Democrats, led by U.S. Sen. Ron Wyden (D-OR), objected to Tuberville’s motion seeking unanimous consent to pass his bill to block the proposal. U.S. Sens Rick Scott (R-FL) and Mike Braun (R-IN) also took to the Senate floor in support of the legislation.

“It’s no secret that I oppose President Biden’s tax proposal,” said Tuberville. “I think it’s bad policy that would undercut growth and derail American prosperity. But one of the worst parts of the President’s plan is the provision requiring financial institutions to report their customers’ transactions of $600 or greater to the IRS.”

Alabama’s junior senator stated that he believes the IRS proposal to be an infringement upon the privacy of consumers.

“That means any time an American pays a bill, makes a deposit, transfers funds, or makes a purchase of $600 dollars or more, their bank or credit union would be forced to report that data to the IRS,” he added. “This would be an unprecedented intrusion into the financial lives of American citizens and businesses – big brother government at its worst.”

He further noted that opposition to the newly-proposed policy is “deep and bipartisan” saying that Americans of all political affiliations do not wish for the IRS to be “looking over their shoulder every time they make a financial transaction.”

Tuberville expressed that he refuses to believe that a majority of the constituents of his colleagues who object to his legislation support the proposal.

“I am sorry to see that my Democratic colleagues oppose protecting the financial privacy of American taxpayers,” Tuberville stated. “That’s a real shame. I think you would be hard-pressed to find a Member of the United States Senate who can honestly say that a majority of their constituents support President Biden’s proposal for the IRS to monitor a $600 or more transaction.”

The senator concluded in part, “We ought to be able to stand up together in a bipartisan fashion to reject this radical proposal. I’m confident that the American people will continue to put pressure on their elected representatives here in Washington to reject this plan.”

The Tuberville-authored legislation has received widespread support among the banking industry. Among the organizations that have endorsed his bill include the Independent Community Bankers of America, National Association of Federally-Insured Credit Unions, American Bankers Association, Credit Union National Association, and the League of Southeastern Credit Unions & Affiliates.

Dylan Smith is a staff writer for Yellowhammer News. You can follow him on Twitter @DylanSmithAL