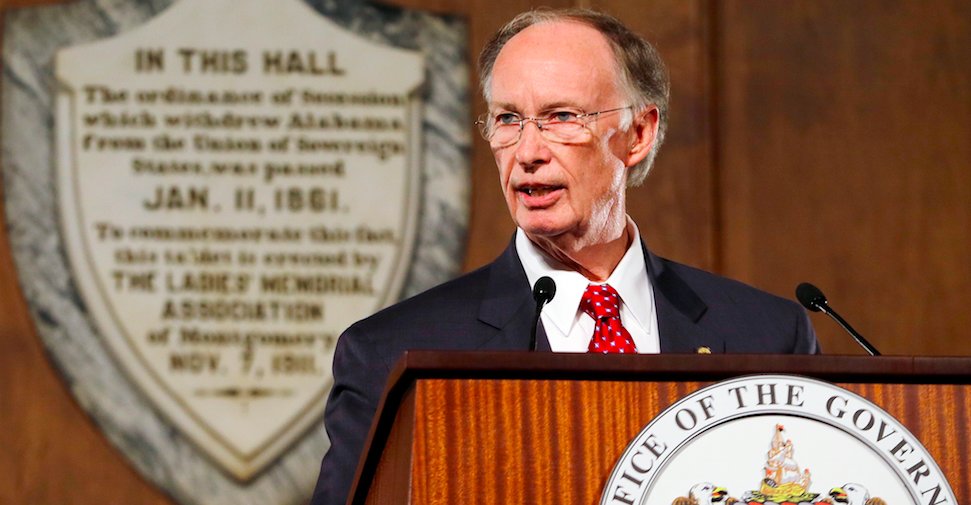

Alabama Gov. Robert Bentley “boldly” (his words) went back on his campaign promise not to raise taxes and proposed a $541 million tax hike last month.

Bentley said in his State of the State address that he believes most Alabama families would not feel the impact of his tax increases.

For that to be true, you’ll need to avoid doing at least these five things:

1. Don’t buy or rent a car

Governor Bentley’s plan would double the state sales tax on car purchases from 2% to 4%. That means if you want to buy an Alabama-built 2015 Hyundai Elantra, you’ll have to pay the government $452 more. For an Alabama-built 2015 Acura MDX, it’ll cost you an extra $855. And for a top-of-the-line, Alabama-built Mercedes M-Class SUV, you’ll have to send your state government almost $2,000 more under the Bentley plan.

In total, this tax would cost Alabamians an extra $200 million per year, according to estimates released by the governor’s office.

Rep. Steve Clouse (R-Ozark), the House General Fund Budget Chairman, is carrying this bill for the governor, but has proposed raising the sales tax on vehicles to 3%, rather than 4%, as the governor had hoped.

Bentley has also proposed raising the sales tax on car rentals to 4%, costing Alabama taxpayers an additional $31 million per year.

2. Don’t use a bank

Gov. Bentley’s plan seeks to raise $1 million by eliminating the tax credit financial institutions receive against the Financial Institution Excise Tax (FIET). Alabama’s FIET law and accompanying exemption dates back to 1935, when the state government gave FIET payers a tax credit to offset any future tax increases from the state. Banks could have been shielded from new taxes levied by the state through federal law, but they agreed to the imposition of the FIET with the condition that they would not be subject to future taxes passed by the state legislature.

Gov. Bentley is now seeking to go back on the 80-year-old agreement, and banks are already signaling they will have to pass the increased costs on to their customers in the form of fees.

“Ultimately, it is the consumer who stands to lose the most,” Alabama Bankers Association President and CEO Scott Latham told Yellowhammer.

RELATED: Study: Bentley bank tax hike will cost Alabama consumers millions

3. Don’t purchase insurance

Insurance taxes are one of the main sources of revenue for the state’s General Fund. The governor’s plan would eliminate some tax exemptions for the insurance business and, according to Bentley’s estimates, cost taxpayers an additional $25 million per year.

No Republicans were interested in carrying the bill, which is already receiving opposition from the influential Alabama Farmers Federation, whose spinoff, ALFA Insurance, is one of the state’s largest insurers. Rep. John Knight (D-Montgomery) is sponsoring the bill for the governor.

4. Don’t use municipal utilities

Do you live in an Alabama city that has a municipal power company — like Piedmont, Sylacauga, LaFayette, Alexander City, Lanett, Opelika, Tuskegee, Luverne, Dothan, Fairhope or Foley? Your bill would go up under the Bentley plan. Ditto if you live anywhere in the state and use municipal water.

Municipal utilities have long been exempt from the state’s 2.2 percent utility tax, but that would no longer be the case under the Bentley plan.

The governor is seeking to raise $47 million by eliminating this exemption, and those costs will be passed along to consumers in the form of higher rates.

5. Don’t purchase tobacco

The typical smoker would have to send Alabama’s state government an additional $304 per year under Gov. Bentley’s plan, which would raise taxes on cigarettes from 43 cents per pack to $1.25 per pack. In total, tobacco users in the state would pay an additional $200 million per year to the government, making them by far the most directly targeted group in the governor’s proposal.

RELATED: Bentley’s $200 million ‘sin tax’ hike is a terrible idea, here’s why (opinion)