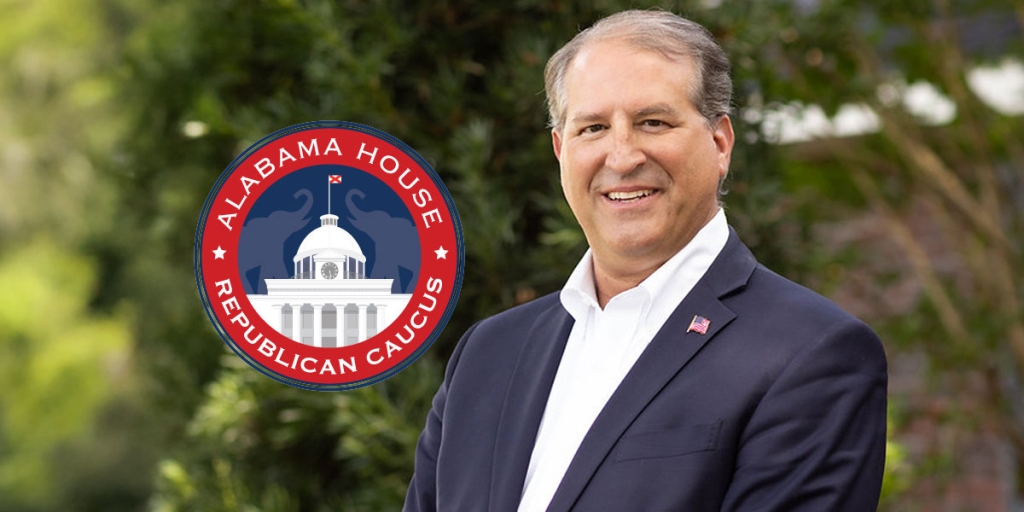

MONTGOMERY, Ala. — Rep. Steve Clouse (R-Ozark), Chairman of the Alabama House General Fund Budget Committee, told Yellowhammer Wednesday that he is planning to introduce a bill eliminating the state tax exemption Alabamians now receive for money paid in FICA and self-employment taxes.

If Rep. Clouse’s bill is passed into law, Alabamians would for the first time have to pay state taxes on money they have already paid in federal taxes.

FICA taxes, or the Federal Insurance Contribution Act, is a 15.3 percent payroll tax split evenly between employees and employers. The revenues pay for Medicare and Social Security. Self-employed Alabamians pay the same 15.3 percent quarterly.

Clouse’s bill would only tax the Social Security portion of the FICA exemption, or 6.2% of gross wages, while the Medicare portion would be untaxed by the state.

The bill would increase taxes on Alabamians by an estimated $195 million per year, which proponents say would help shore up the state’s beleaguered General Fund budget. According to Rep. Clouse, Missouri is the only other state that currently exempts FICA and Self-Employment taxes from factoring income taxes due the state. Massachusetts and Iowa give a partial exemption to the federal tax.

But in addition to those states, seven others (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) don’t tax income at all, and two others (New Hampshire and Tennessee) don’t tax wages.

Eliminating the state’s FICA and Self-Employment tax deduction would cause the median Alabama household to pay approximately $165 more in income taxes to the state each year.

Rep. Clouse told Yellowhammer Wednesday that any revenue from the tax increase wouldn’t be earmarked for a particular program within the general fund. “I think one of the big problems is we’ve got so much earmarking,” Clouse said. “Every part of the general fund is in dire straits from Medicaid to the prisons to public health, and mental health.”

“Unlike the federal government, we have to live within our means,” he continued. “We don’t have a printing press to just print money like the federal government does.”

Clouse said that the state has already cut and borrowed as much as it can, so tax increases are the only way to get out of the hole.

While this proposal is not one that was initially introduced by Governor Bentley in his $541 million tax increase plan, Rep. Clouse is also sponsoring two of the Governor’s tax increase bills in the legislature.

HB267 and HB268, recommended by Gov. Bentley and sponsored by Rep. Clouse, are the Governor’s proposals to increase taxes on Alabamians buying or renting vehicles.

Rep. Clouse told Yellowhammer that he hasn’t begun talking to other members to gauge support for his bill yet. “I don’t know… I’m just throwing options out for the House members to look at… I don’t know what I can get out of committee.”

But if past comments from House leaders are any indication, it will have an especially difficult time gaining steam.

“I am opposed to removing the federal income tax deduction because it would basically require individuals to pay state taxes on their federal taxes which is money they never even received,” House Speaker Mike Hubbard told AL.com in December.

This story will be updated as new details become available.

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015