The Alabama Legislature is entering the final weeks of the 2012 session. I have been pleased with the progress made, but there are still important pieces of legislation left to be considered. Notable bills that I expect to come up for a vote in the next couple of weeks include the general fund budget, the education budget, and charter schools.

In addition to those, one particular bill that I sponsored will be extremely beneficial to existing Alabama businesses as well as new industries looking to locate here. SB 459 creates a streamlined, statewide electronic filing and remittance system for state sales, use, lease and rental taxes.

As part of the Senate’s Initiative to Streamline Government, I served as legislative chair for the Streamlined Sales and Use Tax Commission. Our focus was to study and find ways to improve and streamline Alabama’s current tax structure and regulatory practices. We quickly learned that a major factor that keeps our businesses from growing is the bureaucratic red tape.

The top recommendation from our study was to make it easier for businesses to file taxes by creating a single point of filing. SB 459 does exactly that. This new system, known as ONE SPOT (Optional Network Election for Single Point Online Transactions), will be administered by the Alabama Department of Revenue and will be available to taxpayers, municipalities and counties at no cost. The bill requires the system to be operational in time for returns and payments due during tax periods that begin after Sept. 30, 2013.

A system like this is long overdue in Alabama, as we are the only state that does not currently offer businesses this type of filing. Currently, a business must file different tax returns for every county, city or municipality in which they do business. In some cases, businesses must file up to 150 different returns and write checks to as many as 150 different entities each month. This causes an administrative nightmare. It is not fair to businesses and does not encourage economic growth.

SB 459 passed through the Senate two weeks ago and has been approved by the House Commerce and Small Business Committee. It will now go to the full House for consideration, hopefully next week.

The new ONE SPOT system will not be mandatory for businesses, but it will provide them with a more efficient way to file taxes while relieving the administrative burden that currently exists. I hope the passage of this bill will be another important step to help small businesses grow and thrive in our state.

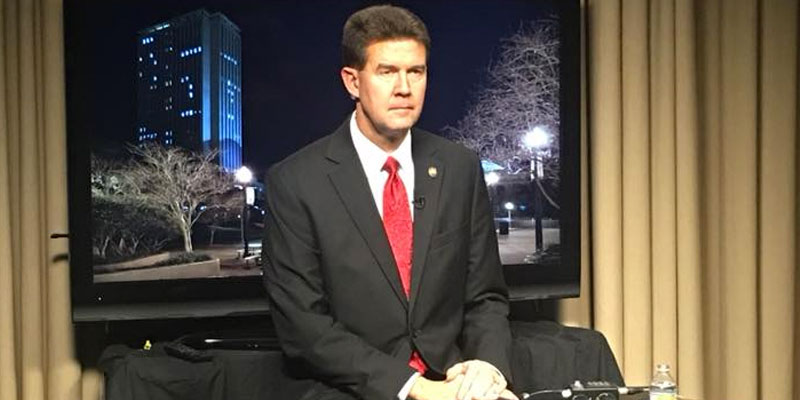

Slade Blackwell is serving his first term in the Alabama State Senate representing Jefferson and Shelby Counties in District 15. For more information about Slade, please visit sladeblackwell.com or follow him on Facebook or on Twitter @sladeblackwell. To reach him by phone, please call 205.396.1144.