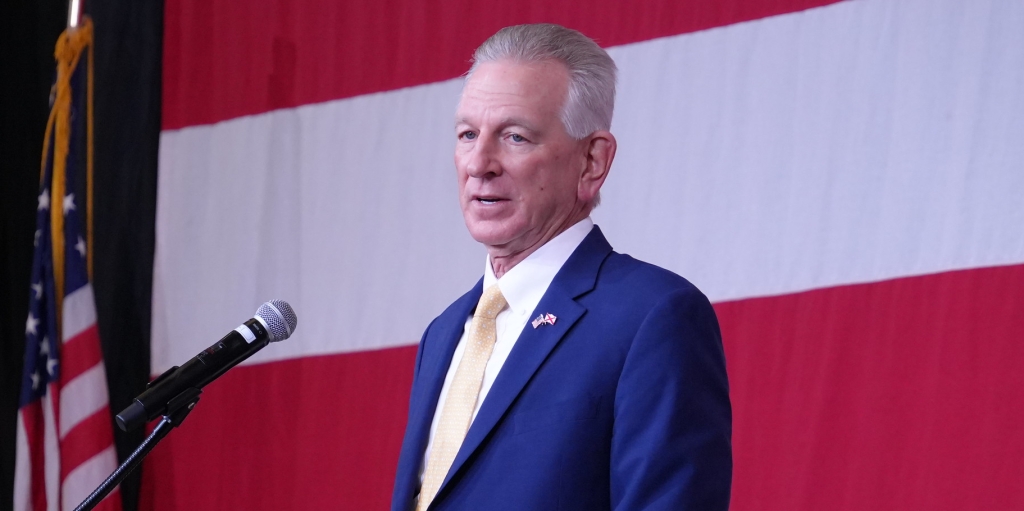

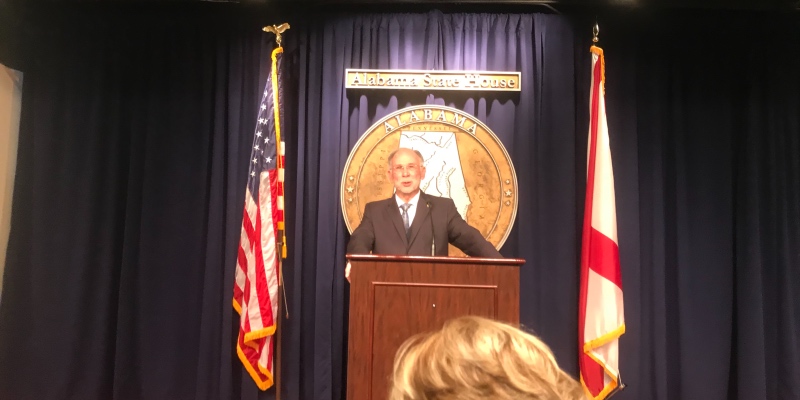

MONTGOMERY — A bill authored by Senate President Pro Tem Del Marsh (R-Anniston) that would voluntarily allow a taxpayer to divert a portion or all of their own state income tax refund to We Build the Wall, Inc. received a favorable recommendation by the Senate Governmental Affairs Committee Tuesday afternoon.

Designated SB 22, the bill would simply add We Build the Wall, Inc. to the list of various programs and organizations that currently receive funds from income tax check-offs under existing law. It would take effect in the 2020 tax year.

A fiscal note on the bill advised that the legislation would not have any administrative cost to the state because obligations of the Alabama Department of Revenue should be offset by the allowed cost of administration of up to tax refund 5 percent of collections. This is not a tax rebate or exemption but a way for citizens to send money already being refunded to them by the state to building the wall.

We Build the Wall Inc. is the non-profit created by Air Force veteran Brian Kolfage to raise money to build the wall along the United States’ border with Mexico for national security purposes.

The bill will now head to the full Senate for a second reading, after which it can be placed on the calendar for consideration.

In a previous statement on SB 22, Marsh explained, “It is obvious that many people in the Federal government have little desire to address border security, so this is an easy way for people in Alabama, if they choose, to check a box and make a donation in support of building a border wall.”

“As I talk to people in my district and around the state, border security is the number one thing I hear about,” he added. “This is obviously an issue that has people very concerned and one that needs to be addressed.”

Thank you to the Governmental Affairs Committee for passing my bill to allow a check off box on Alabama tax returns to donate to We Build The Wall. Strong support for securing our boarders and for @realDonaldTrump #webuildthewall pic.twitter.com/JgO70lSMck

— Del Marsh (@SenatorDelMarsh) March 19, 2019

Sean Ross is a staff writer for Yellowhammer News. You can follow him on Twitter @sean_yhn