Now that it’s the end of April, the federal government will soon release the latest numbers from the Consumer Price Index to officially tell us exactly how much inflation has risen in the past year.

Some people will probably call “BS” on whatever number is generated by the CPI, though, because they believe it’s either inadvertently flawed, purposefully manipulative, or so dense and detached that it’s become practically useless as a means of measurement.

And there’s just no amount of political spin or economic theorizing that can explain those concerns away. Like so many other aspects of our institutions, many people have simply lost trust in the CPI.

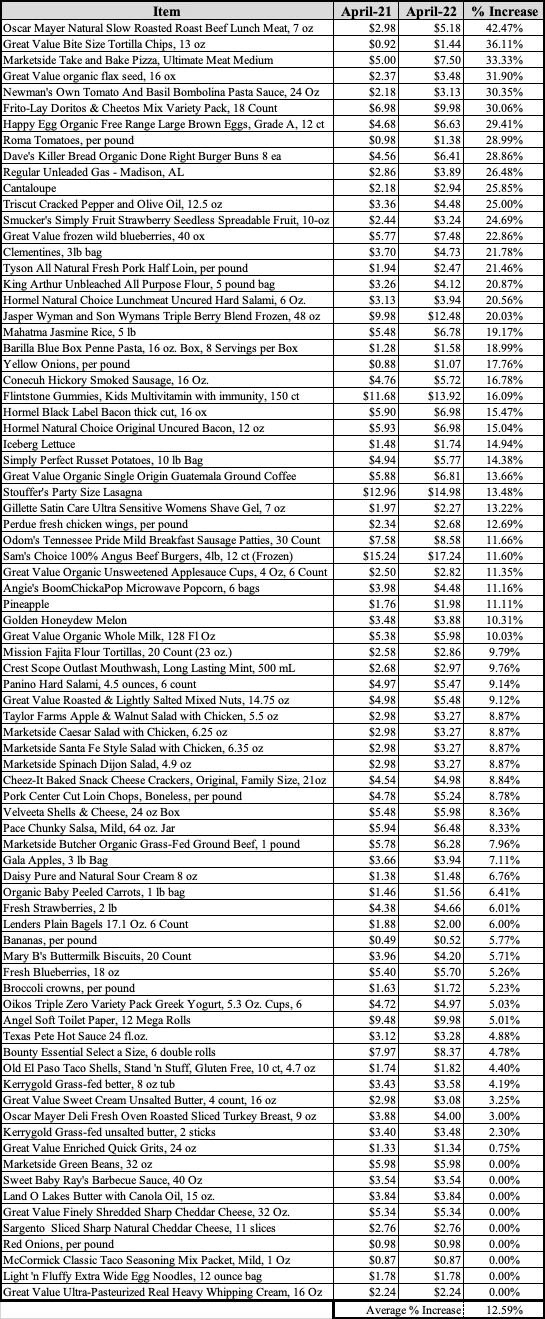

That’s why I created my own index — a “No BS” one, or NBS-CPI as I like to call it — to measure precisely how much more I’m personally spending on my family’s primary non-fixed expenses — groceries and gas. And since we mostly shop through the WalMart Grocery App, I have detailed receipts to base the calculations upon.

So, when a literal apples-to-apples price comparison is made between what I paid for something at Walmart in April 2021 and what it cost now in April 2022, plus the price of regular unleaded down the road, my own NBS-CPI shot-up to slightly more than 12.5%.

That number is probably much closer to measuring the true level of inflation being felt by our nation’s families, and it hasn’t been that high since President Ronald Reagan took office in January 1980.

Here are the numbers:

So, what’s up with the CPI?

Some think the measurement was fundamentally broken after the Bureau of Labor Statistics, which comes up with the number, moved away from tracking a fixed list of products to one where items are removed or added based on price or quality fluctuations.

Critics of the CPI, like stock trader and financial commentator Peter Schiff, have explained that until a couple of decades ago, government economists would track the price of the same basket of products, and the resulting changes would be averaged together to create the inflation rate.

If broccoli was in the basket, it stayed in the basket.

But some economists began arguing that a fixed basket isn’t how people actually shop. They said that if a product becomes too expensive, a shopper would scratch it off their grocery list and replace it with something else less expensive.

So, if broccoli suddenly costs too much, economists assume shoppers will replace the broccoli with, say, Brussel sprouts.

And then the CPI starts tracking the less expensive product.

It’s clear to see what they’re trying to do — base their measurement on dynamic, human behavior rather than a static list — but the flaw in their model is the many assumptions they have to make, and some are probably wrong. (I wouldn’t swap broccoli for Brussel sprouts in my house, for instance. It’d be a total waste. I’m sure you have limitations like that, too).

The Bureau of Labor Statistics conducts surveys and market research to inform those assumptions and make those changes, it says, so they’re not done on a whim. But still, when you dig into what changes they’ve made, and then look at your own behavior (and your own grocery receipts!), it just doesn’t seem right.

Then there’s the argument that the bureaucrat-economists at the Bureau of Labor Statistics have simply made all this far too complicated.

For instance, one would think that coming up with the rate of inflation for a product is a simple calculation:

Increase in Price ÷ Original Price x 100 = % Increase.

Do that for the entire basket of products you’re tracking, get the average percentage of them all, and voilà — the inflation rate. That’s how I calculated my NBS-CPI.

Nope

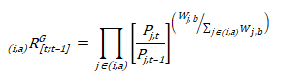

Here’s just one of the formulas they use at the Bureau of Labor Statistics to calculate the CPI:

Decades of problem solving, generations of added processes, and the natural tendency of bureaucracies to construct Byzantine-like labyrinths rather than draw straight lines from problems to solutions has created a Rube Goldberg Machine to calculate what could originally be worked out by a fourth grader.

This is one reason people distrust these numbers: people aren’t capable of checking the government’s homework, and when they take a look they see a myriad of perplexing systems and confusing jargon.

This causes some to believe it’s all a scam, and that these measurements are systemically manipulated for the benefit of those with wealth and power.

Maybe.

After what happened in the subprime mortgage crisis a few years ago, I wouldn’t put anything past Wall Street and their lackeys in Congress.

Much of how the world works can be explained by incentives — what reason does a person have to do one thing and not the other? That, and repeating the question the great orator Cicero asked when evaluating legal claims: “Cui bono?”, which is a Latin phrase meaning “who benefits?”

Find out what the incentives are for an action, and who benefits from it, and you’re probably going to be in the ballpark.

The key word in the title “government economist” is, alas, government. And with the CPI, we’re essentially trusting the government to not only grade its performance in managing the economy, but to create the test, and then change the questions when it doesn’t like the answers.

The incentive, however underlying it may be, is to produce the lowest number for inflation possible.

And who benefits?

Consider what’s hitched to inflation — automatic cost-of-living increases for government employees, some large private employers, and retirees. While not automatic, higher inflation certainly gives employees across the board more of a justification to demand increased wages.

And while I’m uncertain, I suspect that Wall Street has managed to make money from all of this. Maybe someday we’ll learn exactly how.

Going Forward

We’ll see how close the real CPI is to my own NBS-CPI in just a few days. It’ll be closer than last month’s number, which was 8.5%, but not close enough to fully restore my faith in the measurement.

Until then, I plan to release an update of the NBS-CPI on a monthly basis until we’re out of this mess.

(J. Pepper Bryars is Alabama’s only reader supported conservative journalist. You can support his writing by subscribing at https://jpepper.substack.com/subscribe.)