The massive “Build Back Better” spending bill (BBB) being considered by Congress includes a proposed tax credit for electric vehicles (EVs) that discriminates against Alabama auto workers. Specifically, BBB would provide the opportunity for an additional $4,500 in electric vehicle tax credits on top of a broad-based tax credit of up to $7,500 and another $500 for vehicles with U.S.-made batteries.

But there’s a big catch. To qualify for the $4,500 in bonus tax credits, the electric vehicle would have to be made in the United States by union members.

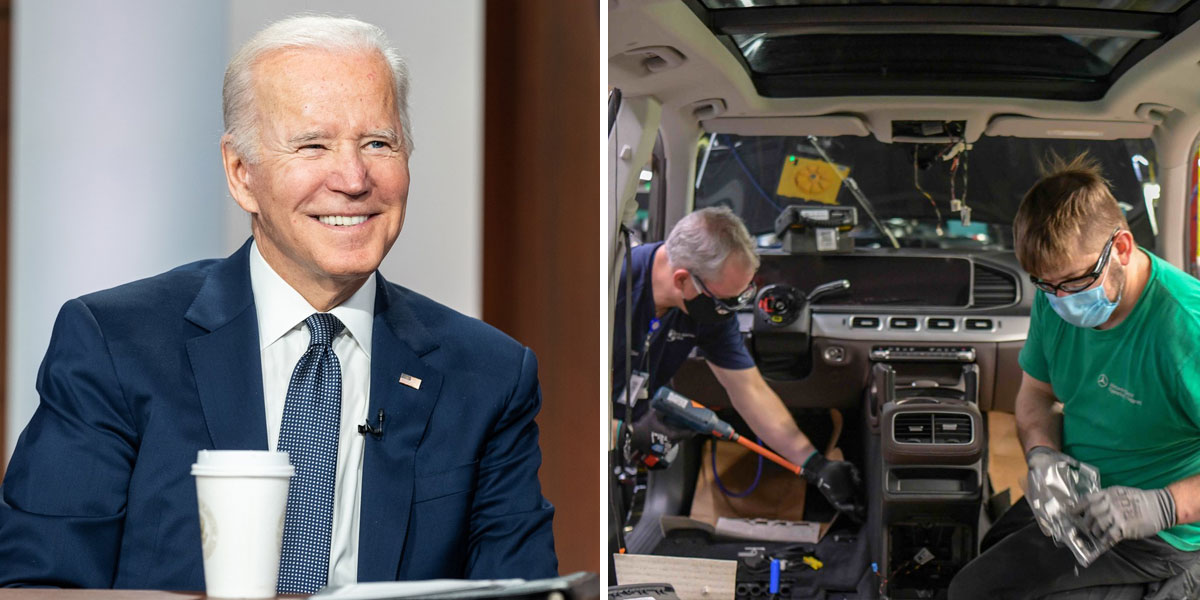

The “Buy American” restriction means imported vehicles would not be eligible to get the additional tax credit. Neither would cars and trucks made in Alabama, because none of the state’s auto factories are unionized. Those left out by Congress would include workers assembling the new Mercedes-Benz electric SUV slated to begin production in Tuscaloosa next year. The EV proposal essentially treats Alabama’s auto workers as foreigners in their own country, simply because they have rejected UAW efforts to organize.

The union-only restriction affects more than just Alabama, since roughly half of U.S. auto workers don’t belong to unions. Ten other governors recently joined Alabama Gov. Kay Ivey in blasting the measure. As the governors said, “This legislation is not about supporting emerging technology but is instead a punitive attempt to side with labor unions at the cost of both American workers and consumers.”

In 2020, a whopping 99% of the UAW’s PAC contributions went to Democratic candidates. A large, union-exclusive tax credit is not a bad return on that investment.

In a letter to House Speaker Nancy Pelosi, 100 Democrats in the House Labor Caucus complained that foreign-owned automakers “consistently choose to invest in right-to-work states.” The goal is rather transparently to strong-arm automakers like Honda, Hyundai, Mercedes, and Toyota that employ around 40,000 Alabama workers to invest elsewhere in the future.

Limiting the EV subsidy to only American-made vehicles is a bad idea in and of itself. Even as Buy American proposals limit consumers’ choices domestically, they encourage other countries to retaliate with “Don’t Buy American” restrictions on U.S. exports.

Alabamians in particular should be very concerned about the risk of foreign retaliation. Motor vehicles are Alabama’s number one export. So far this year, Alabama has exported more vehicles and parts than any state other than Michigan or South Carolina.

Ambassadors from Canada, Japan, Korea, Mexico, and the European Union have pointed out that the proposed EV tax credit would violate U.S. trade commitments, providing a friendly but direct warning that other countries would be unlikely to take this policy lying down. That would potentially result in a one-two punch for American non-union workers — artificially propping up their domestic competition while other countries slap tariffs on their exports.

The discriminatory EV credits are the most recent in a long history of UAW efforts to secure special treatment from the government at the expense of car buyers, ranging from asking Congress to mandate domestic content requirements for auto production to lobbying for a 25% tariff on minivans to requesting a cap on automobile imports from Japan. When the government tries to pick winners, whether through one-sided tax credits, tariffs, or domestic content requirements, Alabama loses.

These restrictions also undermine the alleged goal of proposed EV tax credits, which is supposedly to reduce carbon emissions. If lawmakers truly believed that encouraging the domestic EV market was crucial to combating climate change, they would make the credit broadly available to all environmentally friendly cars and trucks instead of targeting only electric vehicles made in the United States by union workers.

Alabama’s remarkable auto industry growth is an American success story. It illustrates the benefits that international trade and investment brings to U.S. workers, including 8.7 Americans — and nearly 130,000 Alabamians — who work for foreign-based companies. The federal government should not enact EV tax credits that would arbitrarily discriminate against non-union auto workers in states like Alabama.

Bryan Riley is the director of the National Taxpayers Union’s Free Trade Initiative, a nonprofit dedicated to advocating for taxpayer-friendly trade policies at all levels of government.