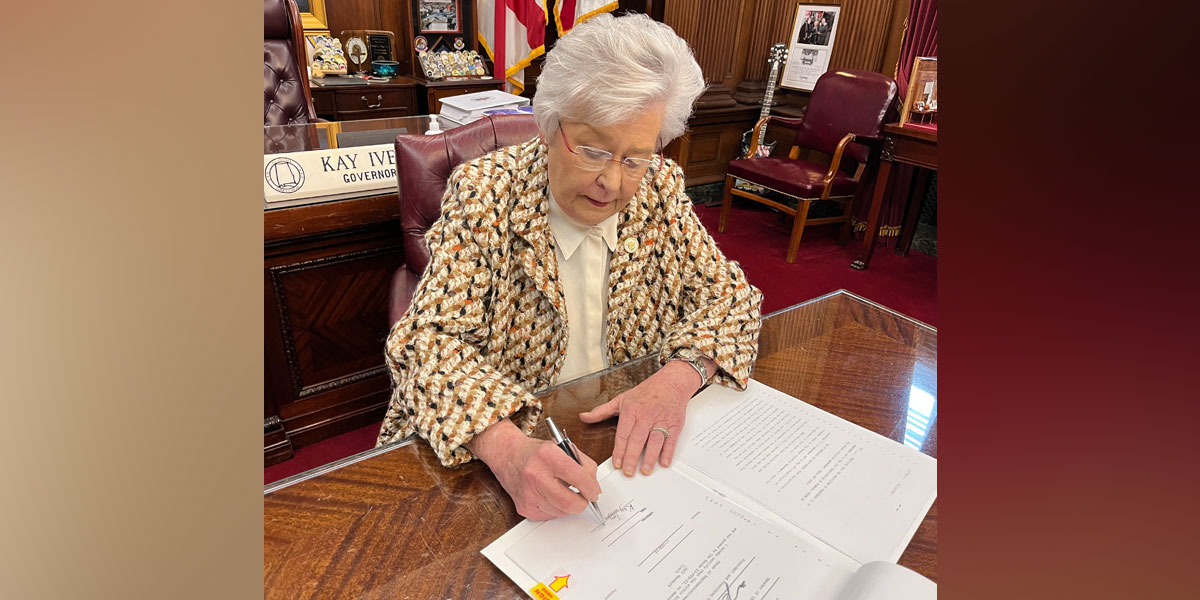

Gov. Kay Ivey signed into law the Small Business Relief and Revitalization Act of 2022 on Monday.

Sponsored by State Rep. Danny Garrett (R-Trussville), the act provides immediate tax relief for small businesses. Included in the bill are multiple corporate and income tax relief provisions and sales tax and business personal property tax relief.

“Small businesses are the pillars of our communities and Alabama’s economy. The Small Business Relief and Revitalization Act will provide much needed and deserved tax relief for these folks,” stated Ivey. “I am grateful to the Alabama Legislature for getting this important piece of legislation across the finish line. I look forward to continually supporting Alabama’s many small businesses.”

The bill ensures that loan forgiveness provided to disadvantaged farmers under the federally-enacted American Rescue Plan Act (ARPA) is not treated as taxable income by the state. Additionally, the act provides a one-month extension of the tax return due dates for Alabama financial institution excise taxpayers and corporate income tax taxpayers.

The act reduces the estimated sales tax payment on more than 2,400 small businesses through increasing the threshold calculation from $2,500 to $5,000 and allowing sales tax licensees the option of a payment of certified funds in lieu of securing a surety bond. Also provided under the law is an exemption of up to $40,000 of market value from the state business personal property tax.

State Sen. Garlan Gudger (R-Cullman) carried the bill in the legislature’s upper chamber.

Dylan Smith is a staff writer for Yellowhammer News. You can follow him on Twitter @DylanSmithAL