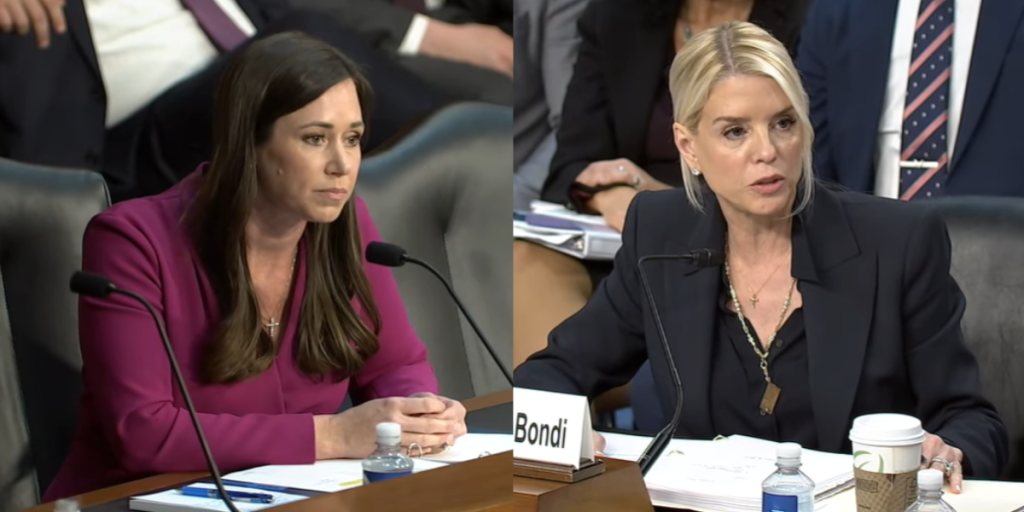

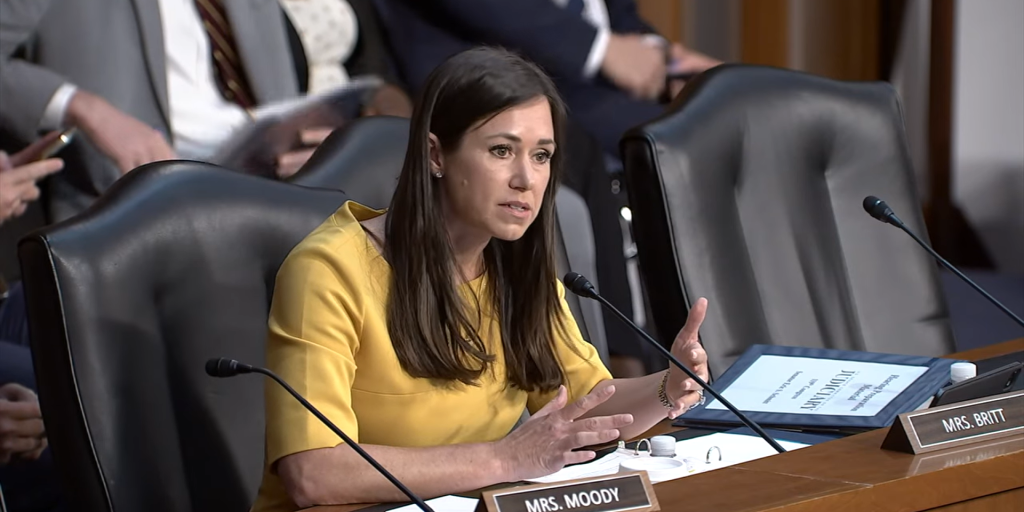

Sen. Katie Britt joined with Sen. Elizabeth Warren to introduce bipartisan legislation Friday allowing federal regulators to regain compensation from bank executives who played a role in their organizations’ failure.

The Failed Bank Executives Clawback Act is a response to the collapses of the Sillicon Valley Bank (SVB) and the Signature Bank. Specifically, it would strengthen the existing authority of the Federal Deposit Insurance Corp. to regain bank executives’ compensation when “they are found to have substantially contribute to the collapse of a financial institution by engaging in reckless business practices.”

“When executives drive financial institutions into failure with reckless business practices, they shouldn’t be allowed to use their golden parachutes to escape responsibility while their customers, their employees, and hardworking American families are left footing the bill for the failure of their bank,” said Britt (R-Montgomery). “This common sense legislation will dissuade risky bank mismanagement and ensure that bad actors are held accountable.”

All funding regained, according to the legislation, will return to the FDIC’s Deposit Insurance Fund.

Other co-sponsors included Sens. J.D. Vance (R-Ohio), Bob Menendez (D-N.J.), Mark Warner (D-Va.), Kevin Cramer (R-N.D.), Chris Van Hollen (D-Md.), Tina Smith (D-Minn.), Raphael Warnock (D-Ga.), John Fetterman (D-Pa.), Catherine Cortez Masto (D-Nev.), Josh Hawley (R-Mo.), and Mike Braun (R-Ind.).

Austen Shipley is a staff writer for Yellowhammer News.