Apple Inc. (AAPL) topped Fortune Magazine’s 2013 list of the world’s most admired companies. The California tech giant maintains a rabid following while raking in record profits. Last quarter Apple posted posted $13 billion in net income, making it the most profitable company in the world during that time frame.

So what does Apple do with all of that money?

In 2011, while the U.S. government debated whether or not to raise the debt ceiling, Apple had more cash on hand ($76 billion) than the U.S. Treasury ($74 billion). Since then, the size of Apple’s stash has almost doubled. As of a month ago, Apple had an astounding $145 billion in cash reserves.

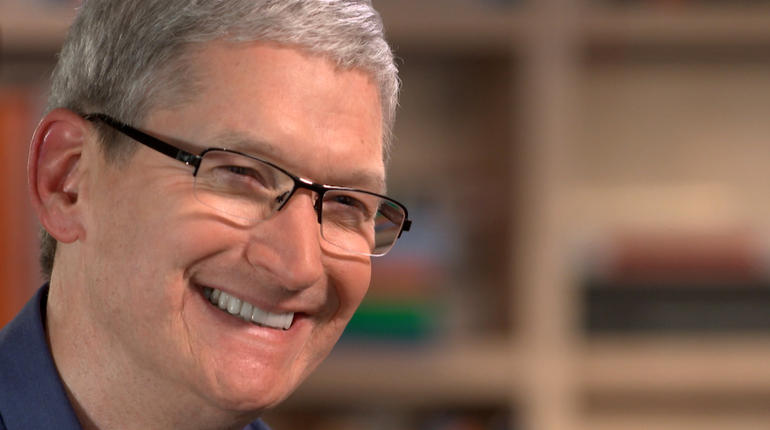

That’s all well and good, but Uncle Sam started growing restless when he realized he couldn’t get his hands on the profits that Apple has been earning overseas. So the Senate Homeland Security and Governmental Affairs Permanent subcommittee on Investigations decided it was time to bring in Apple CEO Tim Cook to explain himself.

Prior to the hearing, members of the subcommittee said they had documentation showing Apple had dodged taxes on $44 billion in income during a three year period between 2009 and 2012. In reality, it appears Apple had simply chosen not to bring money made overseas back into the United States because the IRS would rob them at the border.

“We do have a lower tax rate outside the United States. But this tax rate is for products that we sell outside the United States, not within,” Cook said during his voluntary testimony before the subcommittee. “There’s no shifting going on… We pay all the taxes we owe, every single dollar.”

Cook said that Apple is “likely the largest corporate income tax payer in the U.S.” And suggested the government quit pestering companies and instead fix its own broken tax system that “has not kept pace with the advent of the digital age and the rapidly changing global economy.”

Arizona Senator John McCain wasn’t impressed.

“Apple claims to be the largest U.S. corporate tax payer, but by sheer size and scale, it is also among America’s largest tax avoiders,” he said. “Apple’s corporate tax strategy reflects a flawed corporate tax system — and it’s a system that allows large multinational corporations to shift profits offshore to low-tax jurisdictions.”

…Allows…? How about forces?

America’s outrageous corporate tax system demands anyone with a brain avoid it by any legal means available.

Senator Rand Paul chimed in that he was offended by the proceedings.

“Tell me a politician who is up here and doesn’t try to minimize his taxes,” the Kentucky Senator demanded. “I am offended by a government… that convenes a hearing to bully one of America’s greatest success stories. If anyone should be on trial here, it should be Congress. I frankly think the committee should apologize to Apple.”

Instead of grilling their CEO about why Apple chooses not to bring profits earned overseas back into America, why don’t we reduce or abolish our highest-in-the-world (35%) corporate tax rate so that the smart play is to bring money into the country, instead of keep it out?

Wouldn’t it be nice if the almost $2 TRILLION dollars in corporate profits currently sitting offshore flooded back into the country to create jobs and opportunities right here at home?

Unfortunately, it seems most elected officials in Washington are more concerned with finding ways to funnel more money into the coffers of the American government, rather than into the pockets of the American people.