MONTGOMERY, Ala. — A bill being considered by the Alabama Senate would require any corporation doing business in Alabama to file a “unitary” tax return with the state.

Here’s how current Alabama law works: If a company based in another state does business in Alabama they file and pay taxes only on the income earned in Alabama based on a formula applied by the Alabama Department of Revenue (ADOR).

Under the bill, SB51, companies and their affiliated entities would need to file all of their income with ADOR, whether or not it was earned in Alabama, and the department would determine the amount of taxes due. The statute would also apply to Alabama-based businesses who do commerce in other states.

The bill has long been a goal of many Democratic lawmakers who say corporations based in other states but doing business in Alabama have been avoiding paying their fair share in taxes by exploiting a loophole in the law.

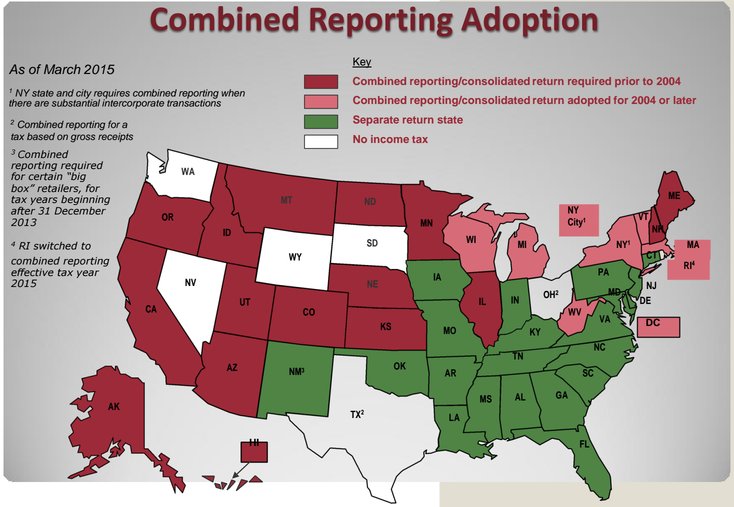

Opponents of the law say none of Alabama’s surrounding states, with whom we are often competing for industry, has a similar provision, so it would keep new companies from coming to the Yellowhammer State.

The Business Associations’ Tax Coalition (BATC), a coalition of business and trade associations representing every major classification of business in Alabama says the bill also gives the Alabama Department of Revenue unprecedented authority to “unilaterally determine tax policy and creates a bureaucratic nightmare resulting in delays and confusion for the taxpayer.” When Georgia considered implementing required combined reporting it found it would cause job losses and dropped the idea.

The Legislative Fiscal Office estimates the bill would increase revenues to the Education Trust Fund by $30 million annually.

Should it pass, the law would be applied retroactively to the beginning of 2015.

“This Senate legislation singles out winners and losers while targeting the business sector in Alabama and placing a disproportionate burden on business,” said BCA president and CEO William J. Canary in a “alert” to the Association’s members. “SB51 is clearly a deterrent to job creation. It expands government and the powers of the Alabama Department of Revenue while increasing business taxes.”

With much of the business community against the bill, Montgomery insiders contend it will not be successful in the Special Session, but warn it could pop up again.

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015