Credit unions in Alabama continue to work diligently to meet the financial needs of the states’ families and businesses during the ongoing coronavirus (COVID-19) pandemic.

The Alabama Credit Union Association (ACUA), an affiliate of the League of Southeastern Credit Unions (LSCU), on Friday outlined in a release some important information on behalf of the member credit unions ACUA represents in Alabama.

“Alabama’s credit unions remain open and ready to serve their members during this difficult time,” stated Patrick La Pine, LSCU CEO. “Credit unions are integral parts of their communities – and they understand the challenges their members face. During this trying time, Alabama credit unions will continue to do what they’ve always done: help consumers, families, businesses and communities through their challenges. Credit unions are also doing everything possible to make sure their teams are safe while still offering personalized service.”

ACUA’s release emphasized that financial institutions are prepared and able to be a source of strength for the communities they serve.

Additionally, the release outlined that money is safe in National Credit Union Administration (NCUA) and Federal Deposit Insurance Corporation (FDIC) insured financial institutions.

- Not a penny of deposits insured by NCUA has ever been lost.

- The safest place for our money is in an insured depository institution.

- Up to $250,000 is the basic amount covered by federal insurance for single amounts at

any insured institution. Additional coverage may be available depending on the account type and structure.- NCUA insurance coverage details are accessible here.

“The Alabama Credit Union Administration is continually communicating with credit unions to offer assistance during this pandemic,” said Greg McClellan, administrator of the Alabama Credit Union Administration. “Credit unions are insured by the NCUA up to $250,000. Credit unions we have been in contact with have been striving to provide excellent service to their members, and we continue to provide assistance to them.”

ACUA advised that consumers and businesses should know the following:

- Credit unions are working proactively with borrowers experiencing challenges in the current

environment.

- Each credit union is eager to work with you for a solution customized to your situation

- Financial institutions have responded positively to all Gov. Kay Ivey’s and President Donald Trump’s directives. Furthermore, business continuity plans were already in place and are being exercised.

- Lobby access may be restricted at certain credit unions, but we’re open for business (check your financial institution’s webpage or LSCU’s list of credit union changes for more information.):

- Drive-through service, when available at a branch, is open for transactions.

- Individual appointments for in-person meeting are being scheduled.

- Technology platforms give ready access to online services like bill pay, remote depositing of checks and ATMs for cash.

- Take advantage of the United States’ world-class payments system and use mobile payment channels and debit cards or credit cards to make purchases.

- Be on guard for scams. Resources are:

- FTC Coronavirus Scams Page

- NCUA: Scams related to the coronavirus of which credit unions and consumers should be aware

- CFPB: Beware of potential scam attempts

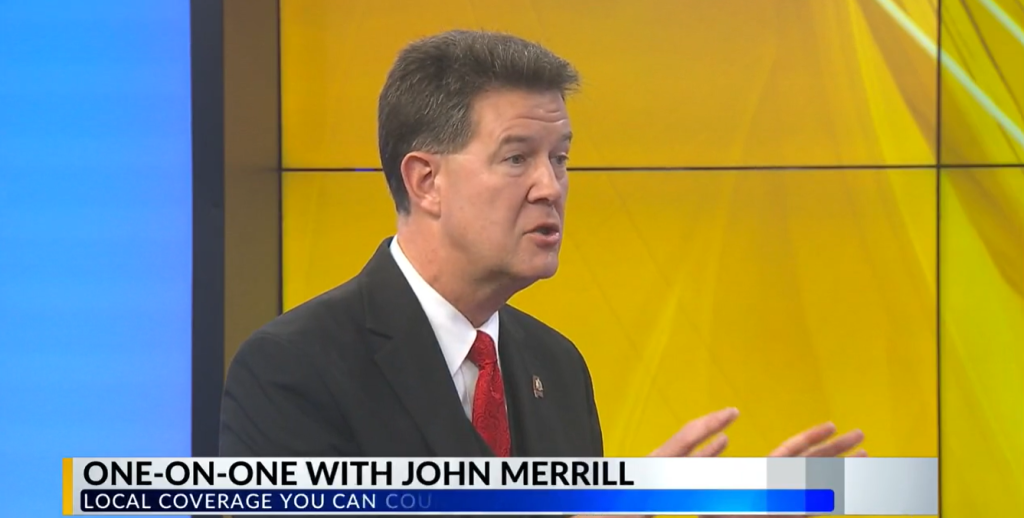

Elected officials from around Alabama praised the state’s credit unions for their response to the coronavirus pandemic.

“With the threat of COVID-19 in Alabama, credit unions are doing all they can to put their members at ease and lessen the financial strain on Alabama’s families and businesses,” remarked Lt. Governor Will Ainsworth.

“The Alabama Credit Union Association and the League of Southeastern Credit Unions are being proactive during this public health emergency to find options that best serve their credit unions. I want to thank them for continuing to reassure consumers their money is safe,” he added.

“In these uncertain times, it is great to see the Alabama Credit Union Association and their member credit unions stepping up to ensure Alabamans that their money is safe and secure. I also want to thank all of Alabama’s credit unions for stepping up to help their members and communities as we adjust to the new normal in our great state,” commented State Rep. Chris Blackshear (R-Phenix City), who serves as chairman of the House Committee on Financial Institutions.

“As always, in Alabama, we pull together, we do the right things for the right reasons and we come out stronger at the end. Our credit unions are no exception. They understand what difficulties may lie ahead for their members, our constituents and they’re helping now, not later before it’s too late,” added State Sen. Tom Whatley (R-Auburn).

The praise was not just bicameral but also bipartisan.

“Many people across the state of Alabama rely on credit unions to handle their financial needs, and they should continue to feel confident in investing their money in NCUA-insured and backed credit unions during the COVID-19 pandemic,” concluded State Rep. Jeremy Gray (D-Opelika). “Credit unions across the state are taking every proactive measure they can, in conjunction with the League of Southeastern Credit Unions and the Alabama Credit Union Association, to ensure they can meet the needs of all of their current and new members.”

RELATED: Keep up with Alabama’s confirmed coronavirus cases, locations here

Sean Ross is the editor of Yellowhammer News. You can follow him on Twitter @sean_yhn