The State Superintendent of Education has released the names of 78 Alabama schools that are now designated as ‘failing’ under the Alabama Accountability Act. Under the Act, students who are enrolled in or assigned to these schools will now have the opportunity to transfer to a nonfailing public school or nonpublic school should they choose to do so. Administrators and instructors who found their schools on the list have understandably expressed displeasure and argue that the school will have a difficult time improving with less student revenue due to transfers.

The State Superintendent of Education has released the names of 78 Alabama schools that are now designated as ‘failing’ under the Alabama Accountability Act. Under the Act, students who are enrolled in or assigned to these schools will now have the opportunity to transfer to a nonfailing public school or nonpublic school should they choose to do so. Administrators and instructors who found their schools on the list have understandably expressed displeasure and argue that the school will have a difficult time improving with less student revenue due to transfers.

With similar school choice programs now operating in 12 other states, this concern has already been analyzed and research shows that it is largely unfounded.

Studies show that students who choose to remain in under-performing schools are not subjected to any further disadvantage, but oftentimes show academic improvement despite a reduction in revenue that comes when some students transfer out. This can be attributed to the competition that school choice introduces into a state’s school system. The same administrators who are unhappy now will have an added incentive to make necessary changes in administration and instruction with the goal of removal from the ‘failing’ list and winning students back to their schools. When this happens, the Accountability Act has served its purpose.

At the heart of this law, and similar state laws across the nation, is the desire for government resources to be used in a way that gives students the best chance for educational success, regardless of where they live.

Shortly after the failing schools list was released, the Department of Revenue announced its determination that the Act does not extend tax credit eligibility to parents of students who were already attending nonpublic schools. Without addressing the Department’s interpretation of the law, its decision means that families residing in failing school districts who have struggled financially to send their children to private schools are ineligible for the Accountability Act’s tax credit.

Some states, like Oklahoma, do not restrict eligibility past the requirement that a student be zoned for a failing school. Other states, like Pennsylvania, use a means test to enable families with a student previously enrolled in a private school to receive a tax credit if the household income is below the designated threshold. Ideally, Alabama’s law will be clarified to incorporate families in failing school districts who found a way, prior to the Act’s passage, to send their children to a better school.

Alabama has consistently ranked near the bottom third in education, but the Accountability Act offers the state a chance to see real results in our educational outcomes. The Act provides both incentives to improve and tools to aid schools in improvement through innovation. Alabamians should take pride in the priority that our state places on K-12 education and should support efforts to see taxpayer money spent prudently. If the Act prompts the 78 schools that are currently failing to focus their energy and resources toward the goal of improved academics and efficiency in administration, the result will be a major victory for students and taxpayers alike.

Katherine Robertson serves as senior policy counsel for the Alabama Policy Institute (API). API is an independent, non-profit research and education organization dedicated to the preservation of free markets, limited government and strong families. If you would like to speak with the author, please call (205) 870-9900 or email her at [email protected].

Related:

1. Legislature Rejects Bentley Amendment, Pushes Forward With Accountability Act

2. Alabama Should Push Forward with School Choice

3. Polling Shows Strong Public Support for GOP School Choice Legislation

4. INTERVIEW: Senator Scott Beason Discusses Education Reform

What else is going on?

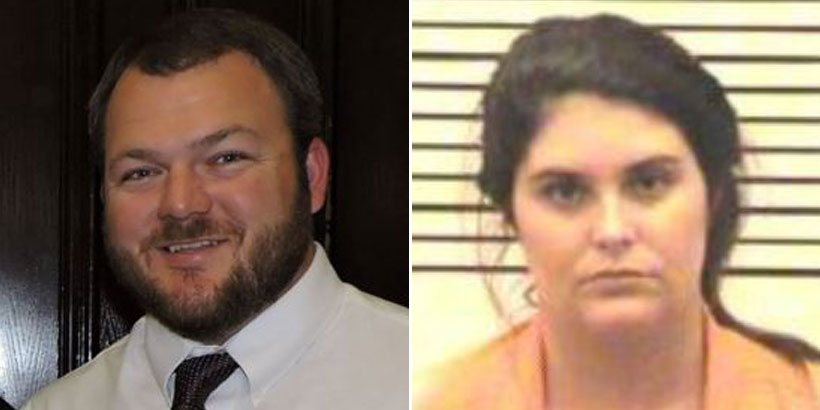

1. Nodine gets a shout out on MSNBC

2. Alabama delegation votes 6-1 along party lines in unexpected defeat of farm bill

3. Shelby co-sponsors bill to repeal Death Tax

4. PERSONAL BLOG: Does God only help those who help themselves?

5. Baldwin Co. GOP chair will challenge Nodine’s candidacy if he runs in AL01