Governor Kay Ivey reminded Alabama taxpayers the one-time rebates provided for in her 2023 budget and approved by the state legislature, will be available starting on December 1.

“From the very beginning, it has been my belief that it is the responsibility of government to be good stewards of taxpayer dollars while actively looking for ways to support citizens through tough times,” Ivey said.

“Our country is in the midst of tough times, and Alabama families from all walks of life are unfortunately seeing that their paychecks aren’t going as far as they once did. Thanks to our unwavering commitment to fiscal responsibility, one-time tax rebates will be with our hard-working Alabamians in time for the holidays.”

The amount of each rebate is based on the qualified taxpayer’s filing status:

- $150 for single, head of family, and married filing separate

- $300 for married filing joint

To qualify for the rebates, taxpayers must have filed a 2021 Individual Income Tax return which ALDOR received on or before October 17, 2022. Non-residents, estates or trusts or anyone who was claimed as a dependent during the 2021 tax year do not qualify.

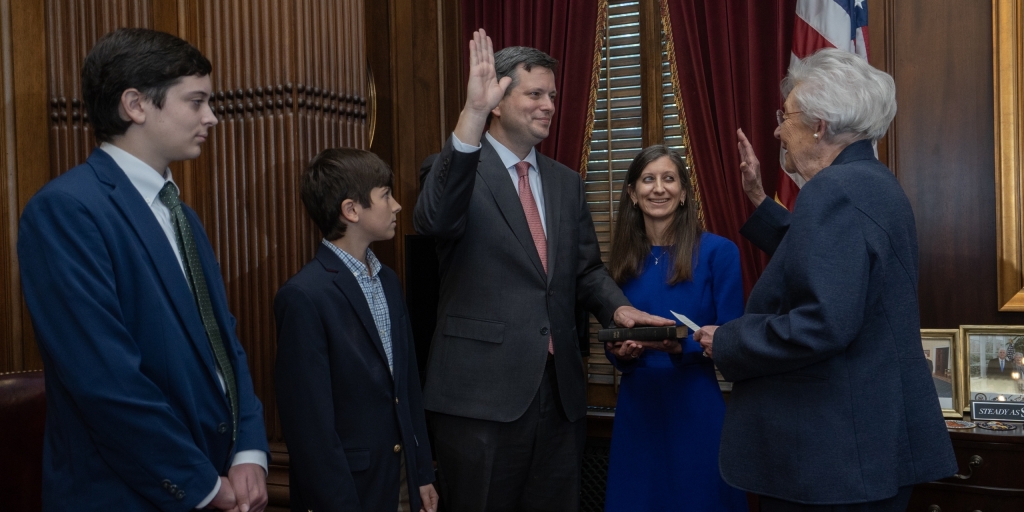

State Senate President Pro Temp Greg Reed touted the state’s economy in relation to the rebates.

“The resilience of hardworking Alabamians and conservative fiscal policies passed by the Legislature have made our state economy strong,” said Reed.

“With a strong state economy built on investment in Alabama’s future, we are equipped to be in a healthy economic position as a state for years to come. Because we are in such a strong economic position as a state, it is our job as responsible stewards of taxpayer money to return money to the people of Alabama through this rebate during the holiday season.”

Austen Shipley is a staff writer for Yellowhammer News.