MONTGOMERY, Ala. — Americans for Tax Reform president Grover Norquist sent a letter to members of the Alabama House of Representatives imploring members to reject a local tax increase in Talladega County.

The legislation, HB338 would add a 5 percent tax increase on the retail and wholesale price “spiritous and vinous liquors,” or liquor and wine.

“Advocates for higher liquor taxes often avoid discussing the economic costs on both employers and consumers,” Norquist wrote in the letter. “Higher tax rates incentivize consumers to flock to places with lower prices. In the case of Talladega County, consumers – especially those living on the border of other counties, will more-than-likely choose to seek out lower prices – driving economic activity elsewhere.”

A report by the Distilled Spirits Council of the United States says that over 60% of the price of a bottle of liquor in Alabama is the result of taxes and fees. The Council estimates that these proposed laws could cost the state $21 million in lost revenue due to customers crossing the state line to buy alcohol in Georgia, where prices are lower.

“The fact is, adult beverages are already one of the most heavily-taxed products on the market,” Norquist said. “Taxes and fees comprise over half the retail cost of beer, wine, and spirits. Increasing taxes on these products in Talladega County would only serve to hurt small businesses who rely on beverage sales. In the end, consumers feel the full force of higher taxes and will seek out lower prices elsewhere.”

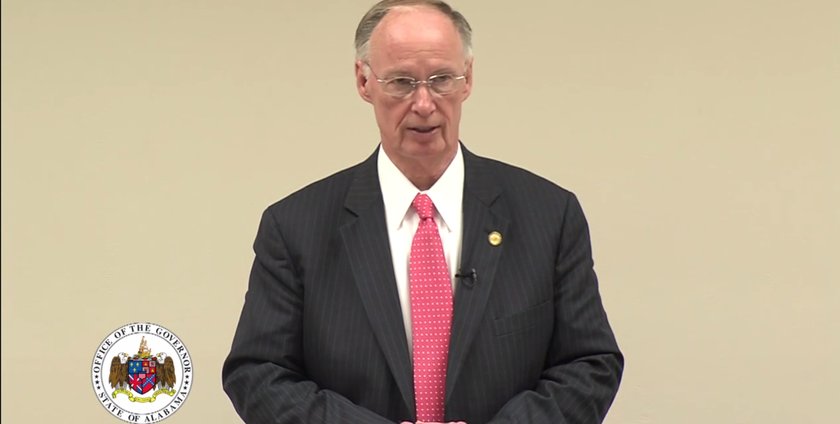

Similar legislation for Calhoun County passed by the State Legislature last month was vetoed by Governor Bentley Thursday morning. Yellowhammer sources close to the situation in Montgomery say the bill earned the Governor’s veto due to a fears that it was unlawful.

Ala. Code § 28-3-284 says “Any county or municipality receiving any additional taxes pursuant to the provisions of this article shall be prohibited from levying any additional taxes or fees on the sale of alcoholic beverages which would be collected by the Alabama Alcoholic Beverage Control Board or its stores.”

It will take 53 votes to override the Governor’s veto, but legislators—who usually stay out of local matters—are reportedly hesitant to be on record casting a vote for a tax increase, particularly if they would be approving something that violates existing law.

Similar bills for St. Clair and Shelby counties are reportedly already in the works, but Governor Bentley’s veto and opposition from conservatives may put a hold on any further legislation.

Like this article? Hate it? Follow me and let me know how you feel on Twitter!

— Elizabeth BeShears (@LizEBeesh) January 21, 2015