Tagged with income tax

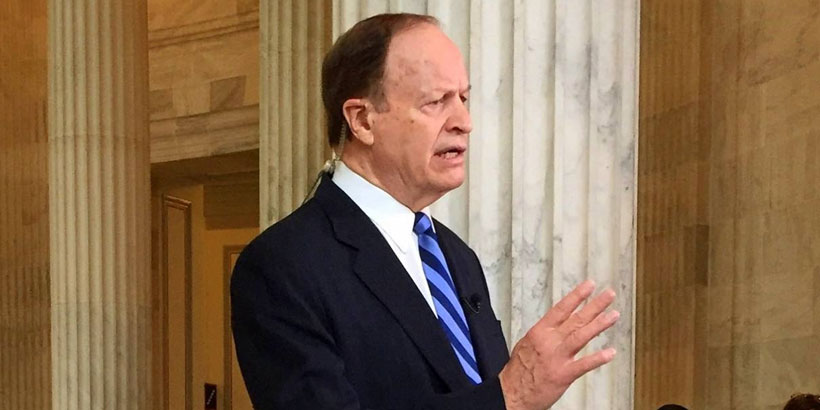

Heath Allbright: ‘Cutting the state income tax will put money back in the pockets of families in District 11’

Signal app issues; no more Alabama income tax; lottery lives; and more on Alabama Politics This Week

7 Things: Tuberville/Rogers concerned about Signal app mistake; removal of income tax gains steam; Americans want deportation; and more …

Alabama GOP lawmakers propose $314.6 million tax cut plan featuring cuts to grocery, retirement and income taxes

Arthur Orr stresses caution on overtime tax exemption, urges lawmakers to consider alternative tax cuts

7 Things: Alabama passes another historically large budget, hot-button bills advance, Alabama vs. Biden and more …

1