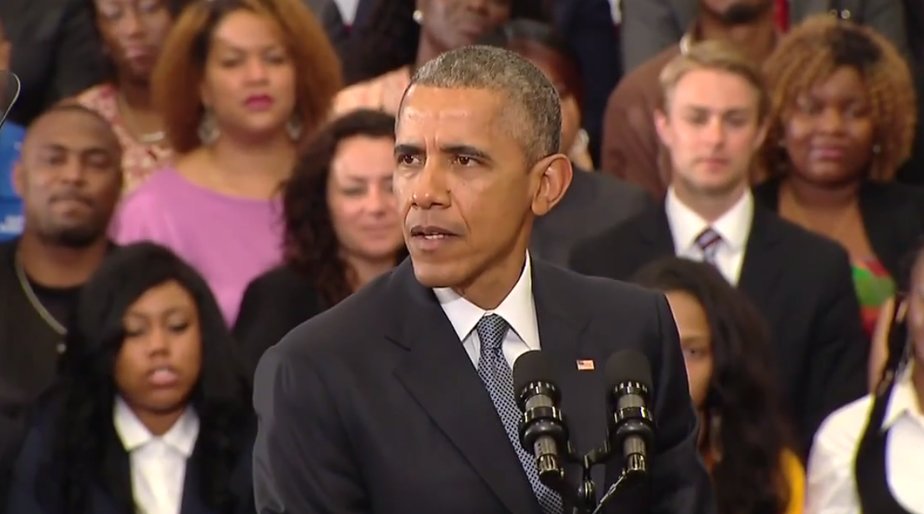

BIRMINGHAM, Ala. — President Barack Obama spoke to a raucous crowd in the Lawson State Community College gym in Birmingham on Thursday, drawing deafening cheers from students and faculty members as he came to the stage to deliver his remarks.

The president started by issuing rare praise to Congress, commending House Speaker John Boehner and House Minority Leader Nancy Pelosi for bringing their deeply fractured caucuses together to pass the so called “doc fix,” which a CNN report describes as a “permanent fix” for Medicare reimbursement for doctors. Conservative groups warned that the bill could drive the country $500 billion further into debt, but it ultimately garnered wide bi-partisan support, passing by a vote of 392-37.

Mr. Obama also touted his plan to provide “free” community college to high school graduates around the country, a proposal that drew head-nods from many of the college students in attendance, but eye-rolls from conservatives who note that taxpayers will ultimately cover the costs.

From there the president reverted to familiar ground, deriding Republicans for placating the “top one-tenth of one percent” of income earners and blasting short-term lenders whose “abusive practices” he said are particularly damaging to the poor.

“Today, (the Consumer Financial Protection Bureau is) taking new steps to crack down on some of the most abusive practices with payday loans and title loans,” Mr. Obama said.

The CFPB is a relatively new agency — their first hearing on payday loans actually took place in Birmingham in 2012 — that, according to USA Today, has “a director nominated by the president but (maintains) its own budget and regulatory power.”

New rules being advanced by the CFBP would regulate short-term lending of all kinds. Lenders would be responsible for verifying that consumers are not taking on too much debt, and there would also be a “cooling off” period between loans, in addition to numerous other more stringent regulations.

“Every year millions of Americans take out these payday loans,” said Mr. Obama. “What they’ll say… is these loans help you deal with a one-time expense… and then that’s the end of it. In reality, most payday loans are not taken out for one-time expenses, they’re taken out to pay for previous loans. You’re borrowing money to pay for money you already borrowed.

“You’ve got some very conservative folks here in Alabama who are reading their Bible and saying, ‘That ain’t right,’” he continued. “You’re taking advantage of them.”

The president claimed that payday loans have interest rates as high as 400%, but defenders of the short-term loan industry say using that terminology is analogous to saying it costs $7,300 to park at the airport for a year because it’s $20 per day. While it is technically true, that price does not accurately reflect how the service is actually used.

Calculating an “annual percentage rate” (APR) does not make sense for loans that are repaid in such a short period of time, they argue. In Alabama, it costs $17.50 to borrow $100 until the next payday. There are no additional fees or compounding interest. The cost is $17.50, regardless of whether the loan is repaid in three days or a month.

Many left-leaning political and “social justice” groups — including Alabama Arise and others here in the Yellowhammer State — have joined the president’s push to ratchet up regulations on the consumer finance industry.

But companies in the industry say the regulations are overburdensome and could shut them down entirely.

And free-market advocates say short-term lending firms are simply filling a need in the marketplace. They also note several differences between the products they offer and the products being offered by credit card companies, banks and credit unions, most notably their willingness to make unusually high-risk loans. In other words, the payday loan interest rates reflect the risk the companies are taking by making the loans in the first place.

Dr. Tom Lehman of the Alabama-based, staunchly free-market Mises Institute said he believes short-term loans are “a legitimate means of extending credit to poor and low-income households who may not otherwise be able to obtain loans due to poor credit histories.”

He also expressed concerns with further government intervention in the marketplace, for which President Obama advocated in his Birmingham speech.

“Further government intervention is not the answer,” he said. “Indeed, it is previous government regulation in the consumer finance industry that has, in part, led to the rapid growth of the very payday lending practices so reviled by critics. As always, the law of unintended consequences prevails, leading to outcomes that are directly opposite those sought by government regulators.”

President Obama, however, said that increasing regulations on payday lenders is a policy he believes people across the idealogical spectrum should be able to get behind.

“We’re all in this together, Alabama,” he said. “If we decide this is our time, then together we will write the next great chapter in America’s history. And we’ll do it not just because I came to town, but because of the people who are doing the work in this town.”

Like this article? Follow me on Twitter and let me know what you think.

— Cliff Sims (@Cliff_Sims) December 3, 2014